SMRs Explained: Real-World Economics, Fuel Bottlenecks, & The Race To Scale

Authored by Michael Kern via OilPrice.com,

The shift to Small Modular Reactors (SMRs) is driven by rising global electricity demand, especially from AI data centers, and the limitations of intermittent renewable energy sources, positioning nuclear as the essential source of 24/7 "firm" baseload power.

SMRs bypass the financial risks of traditional megaprojects like Vogtle by offering shorter construction timelines (3–5 years) and a lower initial cost, trading "economies of scale" for "economies of unit production" through factory-built components.

Key challenges for the SMR industry include the need for mass production to achieve economic viability, managing the waste issue, and navigating the geopolitical risks associated with a highly concentrated global uranium fuel supply chain.

The market fundamentals are finally in place for a new era. Global electricity demand is rising at twice the rate of total energy demand, pushed over the edge by the relentless growth of AI data centers and the slow-motion electrification of the global vehicle fleet. Generation from the world’s fleet of nearly 420 reactors is already on track to reach an all-time high in 2025. This is about a global realization that "intermittent" renewables cannot carry the load of a 24/7 civilization alone.

Baseload power is no longer a luxury; it’s the price of admission for the modern economy.

Why Small Is the Only Way Big Nuclear Survives

If you’ve spent any time reading about energy, you know the term "Small Modular Reactor" is used as a catch-all... it actually refers to three distinct shifts in how we think about the atom.

First, "Small" means anything up to 300 MWe. That is roughly a third of the output of a traditional Gigawatt-scale plant... enough to power about 250,000 homes or a massive industrial complex.

Second, "Modular" is the real economic engine. Instead of custom-designing every pipe and valve on a muddy construction site, components are factory-built and shipped via truck or rail.

Finally, "Reactor" is where the physics get messy. Current designs aren't just "shrunk down" versions of the 1970s light-water tech.

Why Megaprojects Died in Georgia

Traditional nuclear projects like the Vogtle plant in Georgia or Hinkley Point C in the UK have become legendary for their cost overruns. They aren't just power plants; they are multi-decade civil engineering nightmares that consume capital faster than they produce watts.

Vogtle ended up costing over $30 billion... nearly double the original estimate.

No private investor wants to sit on a $30 billion debt for fifteen years before the first dollar of revenue trickles in. SMRs attempt to bypass this "Valley of Death" by shortening construction timelines to roughly 3–5 years and lowering the initial check to something a mid-sized utility or a tech giant can actually afford.

It’s an attempt to trade "economies of scale" for "economies of unit production."

The East Is Building While the West Files Paperwork

The "Nuclear Renaissance" is already happening; it just hasn’t reached the Atlantic yet. Of the 52 reactors started since 2017, nearly half are Chinese, and the other half are Russian.

(Source: IEA)

And the bottleneck isn’t technology…it’s fuel. Russia currently controls 40% of the world’s uranium enrichment capacity. Energy security is a hollow promise if you have to buy the uranium from your primary adversary.

AI Is the Insatiable Beast That Only Fission Can Feed

The tech giants aren't buying nuclear because they've suddenly developed a passion for carbon-free baseload. They’re doing it because their AI roadmaps are hitting a physical wall... a single ChatGPT query consumes roughly ten times the electricity of a Google search.

Amazon, Google, and Microsoft have realized that wind and solar are essentially "part-time" energy sources.

When the sun goes down and the wind stops, the data centers don't. This creates a massive, expensive problem called "intermittency" that batteries aren't ready to solve at a multi-gigawatt scale. The SMR is the only thing on the menu that offers 24/7 "firm" power with a small enough footprint to sit next to a server farm.

For the first time in history, the primary driver for nuclear power is coming from the private sector, not the state.

Microsoft: Signed a 20-year PPA to resurrect Three Mile Island (Unit 1).

Google: Ordered 6–7 reactors from Kairos Power for 500 MW of clean energy.

Amazon: Bought a stake in X-energy and signed an MoU with Dominion for SMR siting.

Oracle: Announced a massive data campus powered by three modular reactors.

By signing 20-year Power Purchase Agreements (PPAs), they provide the bankability that SMR manufacturers need to start their assembly lines.

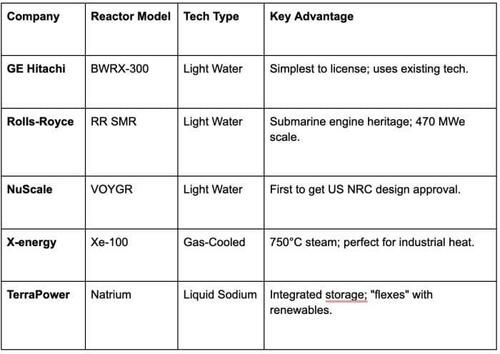

Picking Winners in a Graveyard of Energy Startups

The SMR market is a graveyard of good ideas that ran out of money. To win, a company needs three things: a simple design, a licensed site, and a customer with deeper pockets than God.

The market is split between the "Old Guard" shrinking proven tech and "Disruptors" chasing Generation IV designs.

The $2,500/kW Target: Chasing the Chinese Cost Curve

This is where the marketing brochures usually stop being honest. If you build one SMR, it is the most expensive electricity on Earth. The "Modular" promise only works if you build them like airplanes—in a factory, at scale.

The IEA projects SMR investment will hit $25 billion annually by 2030. That sounds like a lot until you realize that building the first factory for these modules could eat half that budget before the first reactor is even shipped. The "learning curve" for SMRs is a steep and expensive climb. Studies suggest that "learning-by-doing" can reduce capital costs by 5% to 10% for every doubling of production. However, a report by Germany’s BASE suggests that an average of 3,000 SMRs would have to be produced before they reach true economies of mass production.

This is the central friction of the industry. No CEO wants to tell their board they are the "guinea pig" for an unproven $1 billion reactor.

Private funding alone won't work. The long timelines for permitting mean the "breakeven point" for a large reactor is 20-30 years after project start. SMRs cut that timeline in half, but it's still a tough sell for commercial lenders.

This is where Green Bonds and Public-Private Partnerships come in.

Over $5 billion in green bonds have been issued for nuclear so far, and the U.S. DOE’s Advanced Reactor Demonstration Program is throwing billions at prototypes. But the real bridge across the "Financial Valley of Death" is the credit rating of Big Tech. When Google or Amazon signs a 20-year PPA, the debt becomes bankable.

Fukushima-Proofing the Atom With Passive Physics

SMR proponents love to talk about "passive safety"—designs where physics (gravity and convection) cool the reactor even if the power goes out. It’s essentially "Fukushima-proofing" by design. Because these units are smaller, they have a lower radioactive inventory per reactor, allowing them to be placed on the sites of retired coal plants. The need:

Gravity-Driven Cooling: If power is lost, cool water is naturally pulled into the core.

Smaller Cores: Less radioactive inventory means the "exclusion zone" can be significantly smaller.

Underground Siting: Placing reactors below grade adds a natural barrier against external threats.

If we build thousands of SMRs and ship them to remote mining sites or developing nations, we are "distributing" nuclear material across the globe. That is a security nightmare. The fix is "Battery-Style" SMRs: built, fueled, and welded shut in a factory. They are shipped to a site, run for 20 years, and shipped back. The end-user never touches the fuel.

Teaching the NRC to Move at the Speed of Light

The U.S. Nuclear Regulatory Commission (NRC) was designed to regulate massive, one-off light-water reactors. Applying 1970s regulations to 2025 technology is like trying to get a Tesla licensed using rules written for steam engines.

In July 2024, the ADVANCE Act was signed into law, explicitly directing the NRC to streamline the process for microreactors and SMRs. By December 2025, the NRC had already met 30 of its 36 planned deliverables under the act. It’s an attempt to stop the "licensing-by-exhaustion" strategy that has killed so many designs in the past.

International harmonization is the next frontier. If a design is approved in Canada (like the BWRX-300), why does it need to spend another five years and $100 million being "re-approved" in the U.S. or the UK? Strategic leadership is being built in concrete while the West waits for a policy consensus.

The $1.5 Trillion Industrial Heat Prize

Most people think of nuclear as a way to keep the lights on. But electricity is only about 20% of global primary energy demand. The real monster in the room is Industrial Process Heat. If you want to make steel, cement, or glass, you need temperatures that wind and solar simply cannot provide through a wire without massive efficiency losses. Today, 89% of that high-temperature demand is met by burning fossil fuels.

The SMR—specifically the High-Temperature Gas Reactor (HTGR)—is the only zero-carbon technology that can sit "inside-the-fence" with a chemical plant and provide 750°C steam. According to a 2025 study by LucidCatalyst, the potential market for industrial SMRs could hit 700 GW by 2050.

We’re talking about a $1.5 trillion investment opportunity.

The top five markets for this aren't utilities... they are synthetic aviation fuels, coal plant repowering, maritime fuels, data centers, and chemicals.

In October 2025, the European Commission launched its first pilot auction for industrial heat decarbonization. Companies like France’s Blue Capsule are designing reactors specifically for this market.

If SMRs can’t crack the industrial heat market, Net Zero is a mathematical impossibility.

Why Desalination Might Be the Secret Middle East Play

In the Middle East and North Africa (MENA), energy security is inseparable from water security. Arab states currently account for more than 50% of global desalination capacity. Desalination is an energy hog. Traditionally, it’s been powered by oil and gas, but the GCC nations have pledged net-zero goals for 2050–2060.

SMRs offer a "dual-purpose" solution: they provide baseload power for the grid and the massive amounts of heat or electricity needed for Reverse Osmosis (RO) or Multi-Effect Distillation (MED).

In Jordan, an IAEA team recently evaluated studies for using SMRs to pull drinking water from the Red Sea to Amman. In Saudi Arabia, the world's largest desalinated water producer, the government is looking at nuclear as the cornerstone of its move away from an oil-based economy.

The economics are starting to pencil out. Using the Desalination Economic Evaluation Program (DEEP) model, 2025 data shows that high-temperature helium-cooled reactors can produce water at an economically viable range of $0.69 to $1.04 per cubic meter.

Microreactors Are the Frontier Batteries for the Arctic and the Mine

While the 300 MWe reactors get the headlines, a subset of the industry is going even smaller. Microreactors (under 10 MWe) are being designed as "nuclear batteries" for the most austere environments on Earth.

The U.S. Department of the Air Force is the lead customer here. In May 2025, they issued a Notice of Intent to Award a contract to Oklo, Inc. for a microreactor pilot at Eielson Air Force Base in Alaska.

Why Alaska?

Because shipping diesel to remote Arctic bases is expensive, dangerous, and a massive logistical vulnerability.

The Eielson project is a 30-year PPA where the vendor owns and operates the reactor. It is "Mission Assurance" in a 50-below-zero environment. But it’s not just the military.

Remote mining operations in Canada and Australia are looking at microreactors like the eVinci (Westinghouse) or the KRONOS (Nano Nuclear). For a mine that currently spends $50 million a year on diesel fuel, a microreactor that runs for 10 years without refueling isn't just a "green" choice... it’s a massive competitive advantage.

Navigating the Yellowcake Landmine in Kazakhstan and Niger

Now, we have to talk about the fuel. Everything we’ve discussed depends on HALEU (High-Assay Low-Enriched Uranium), and right now, the supply chain is a geopolitical landmine. Kazakhstan currently supplies over 43% of the world's uranium. That is a terrifying level of concentration, especially given the civil unrest seen in the region.

Then there is Africa.

The 2023 military coup in Niger effectively knocked out a reliable supplier for Europe. In 2025, no production was reported from the SOMAÏR mine.

The West is finally waking up. In late 2025, Urenco USA produced its first run of enriched uranium above 5% in New Mexico. Centrus Energy launched commercial enrichment activities in Ohio, targeting HALEU production to meet a $2.3 billion backlog. But new mines take 7–10 years to come online. We are currently in a "seller's market," with uranium prices hitting a range of $86 to $90 per pound in new contracts. If the fuel supply isn't diversified, the SMR revolution will be choked in its cradle.

Overcoming the Duck Curve

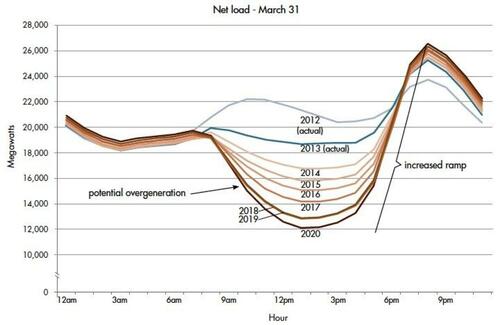

The modern grid is struggling to handle the "Duck Curve"—the massive fluctuation in supply caused by solar and wind.

(Source: DOE)

Traditionally, nuclear was considered "inflexible" baseload... you turned it on and left it at 100% for two years.

SMRs are being designed with Load-Following capabilities.

TerraPower’s Natrium reactor, for example, includes a molten salt heat storage system. This allows the reactor to run at a constant temperature while the storage system "flexes" the electrical output to the grid. When the sun is shining, the reactor stores heat. When the sun goes down, it releases it to generate power.

It turns the nuclear reactor from a "firm floor" into a "flexible battery." This is the missing piece of the renewable energy transition. Without this flexibility, we are forced to keep gas-fired "peaker" plants on standby, which defeats the purpose of the carbon-free goal.

Resurrecting the Rust Belt With Coal-to-Nuclear Pivots

There are over 300 retired or retiring coal plant sites in the United States alone. These sites are energy goldmines. They already have the grid connections, the cooling water access, and, most importantly, a workforce that knows how to run a thermal power plant.

The SMR is the only technology that can "slot" into these sites without requiring a total overhaul of the local economy.

NuScale is currently working with Dairyland Power in Wisconsin to evaluate VOYGR plants for retiring coal sites. It preserves high-paying jobs in rural communities that would otherwise be hollowed out by the move away from coal. It turns a liability (a dead coal plant) into a 60-year asset.

The 2030 Deadline: A Final Verdict for the Assembly Line Era

We have moved past the era of "paper reactors." By the end of 2025, the industry has shifted its focus to the three pillars of success: Licensing, Supply Chain, and Offtake. The technology is no longer the main question... the factory is.

The IEA’s APS scenario calls for 120 GW of SMR capacity by 2050. Under today’s policy settings, we are only on track for 40 GW. The gap between those two numbers represents the difference between a grid that works and a grid that fails.

The next five years (2025–2030) will be the most important in the history of nuclear power. SMRs are not a "silver bullet," but they are the only "firm" floor that makes a clean grid physically possible. If SMR manufacturers can reach a production rate of just one unit per month, the "learning curve" will finally drive costs toward that $4,500/kW target.

If they remain stuck in "bespoke project" mode, they will join the graveyard of 20th-century energy experiments.

The stakes are higher than they’ve ever been.

Between AI’s hunger for power and the world’s desperate need for clean industrial heat, the SMR isn’t just an "option."

For a carbon-free industrial civilization, it might be the only move left on the board. The atomic renaissance is here; the only question is whether the West can build it fast enough to matter.

Tyler Durden

Fri, 01/02/2026 - 20:05

The post <a href=https://www.zerohedge.com/energy/smrs-explained-real-world-economics-fuel-bottlenecks-race-scale target=_blank >SMRs Explained: Real-World Economics, Fuel Bottlenecks, & The Race To Scale</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...