Key Events This Week: All Eyes On The Fed And BOE

After the busiest week of Q1 earnings season, and a blockbuster week for macro, which included a stronger than expected jobs report, we enter a week that should see attention turn back towards central banks, with the latest Fed (Wed) and BoE (Thu) decisions due. These come as markets have largely shaken off the tariff-driven stress of the past few weeks, as rising optimism on tariff de-escalation and Friday’s solid US payrolls print brought the S&P 500 back above its pre-Liberation Day level, with the index posting its longest winning streak since 2004. Admittedly, the recovery has been far from even across asset classes. A notable laggard is the US dollar, trading nearly -4% below April 2 levels this morning. Investors will continue to keenly watch the tariff headlines and peruse the latest evidence of tariff impacts in this week’s data ranging from the US April ISM services (today) to German factory orders (Wed) and China’s April trade data (Fri).

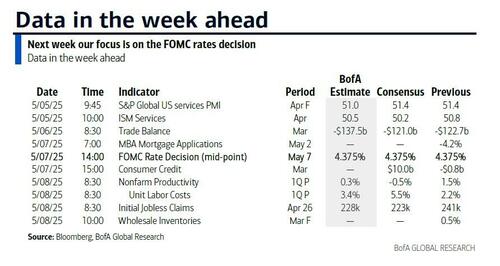

The full day by day week ahead is at the end as usual, but the main highlight will be the Fed's decision on Wednesday and Chair Powell's press conference afterwards. Most economists expect the Fed to keep rates steady and avoid explicit forward guidance about the policy path ahead. They see the overall tone as likely to echo recent Fed comments that the administration's policies are likely to push the economy away from the Fed's dual mandate objectives for a period of time but that monetary policy is "well positioned" to respond to the evolving outlook. Rate cut expectations were pushed back after the strong jobs report, with risks for further easing contingent on a weaker labor market rather than the Fed delivering pre-emptive cuts. Fed funds futures are pricing a 37% chance of a cut by the next meeting in June, with a full 25bp cut priced by July.

In terms of the rest of the week ahead, central banks will also be in focus in Europe, with policy decisions from the UK, Norway and Sweden all due on Thursday. The BoE is expected to deliver a 25bp cut that would take the Bank Rate to 4.25%, while Norges and Riksbank are expected to keep rates on hold. Meanwhile, the ECB will hold an informal meeting on May 6-7 to discuss its 2025 monetary policy strategy assessment, which our European economists preview here.

Turning to economic data, in the US the main test ahead of the Fed will be today’s April ISM services reading, which economists see declining to 50.3 from 50.8. That comes as the April data so far, including a decent US ISM manufacturing print last week, have shown few signs of either the US or the global economy ‘breaking’ from the tariff turmoil even as sentiment indicators paint a worrying picture.

It will be a pretty quiet data week in Europe, with Germany’s factory orders (Wed) and industrial production (Thu) prints the highlights, while in Asia the April trade figures out of China (Fri) are expected to show a material slowing amid the tariff disruption.

In corporate earnings, key US releases include Palantir, AMD, Walt Disney and Uber. In Europe, earnings from the likes of Novo Nordisk, Siemens Energy, AP Moller-Maersk, BMW, AB InBev and Rheinmetall will be of extra interest in light of the trade tensions.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 5

- Data: US April ISM services, Switzerland April CPI

- Earnings: Vertex, Williams, CRH, Ares, Diamondback Energy, Ford, BioNTech, ON Semiconductor

- Auctions: US 3-yr Notes ($58bn)

- Data: US March trade balance, China April Caixin services PMI, UK April official reserves changes, new car registrations, France March industrial production, Italy April services PMI, Eurozone March PPI, Canada March international merchandise trade

- Earnings: Palantir, AMD, Arista Networks, Intesa Sanpaolo, Ferrari, Constellation Energy, Zoetis, Marriott, Coupang, Fidelity, Electronic Arts, Datadog, IQVIA, Rivian, Vestas, Astera Labs, Zalando

- Auctions: US 10-yr Notes ($42bn)

- Data: US March consumer credit, China April foreign reserves, UK April construction PMI, Germany March factory orders, April construction PMI, France March trade balance, current account balance, Q1 wages, private sector payrolls, Italy March retail sales, Eurozone March retail sales, Sweden April CPI

- Central banks: Fed's decision

- Earnings: Teva, Novo Nordisk, Walt Disney, Uber, ARM, MercadoLibre, DoorDash, Fortinet, Siemens Healthineers, BMW, Carvana, Axon, Vistra, Flutter Entertainment, Occidental Petroleum, Barrick Gold, Legrand, Rockwell Automation, Vonovia, Orsted, Pandora, Telecom Italia, Sandisk

- Data: US Q1 nonfarm productivity, Q1 unit labor costs, March wholesale trade sales, April NY Fed 1-yr inflation expectations, initial jobless claims, UK April RICS house price balance, Germany March industrial production, trade balance

- Central banks: BoE, Riksbank and Norges Bank decision, BoJ minutes of the March meeting, BoE's April DMP survey, BoC financial stability report

- Earnings: Toyota Motor, AB InBev, Shopify, ConocoPhillips, Nintendo, DBS, McKesson, Enel, Rheinmetall, Siemens Energy, Coinbase, Cheniere Energy, Infineon, Kenvue, HubSpot, TKO Group, Leonardo, AP Moller - Maersk, Warner Bros Discovery, Toast, Expedia, Pinterest, DraftKings, Affirm, Tapestry, Illumina, Banca Monte dei Paschi di Siena, Rocket Lab, Paramount Global, Davide Campari-Milano, Crocs, Lyft, Puma, Peloton, Sweetgreen

- Auctions: US 30-yr Bonds ($25bn)

- Data: China April trade balance, Q1 BoP current account balance, Japan March labor cash earnings, household spending, leading index, coincident index, Italy March industrial production, Canada April jobs report, Norway April CPI

- Central banks: Fed's Williams, Waller, Kugler, Goolsbee and Barr speak, ECB's Simkus and Rehn speak, BoE's Bailey and Pill speak

* * *

Finally turning to the US, the key economic data release this week is the ISM services report on Monday. The May FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements by Fed officials on Friday, when the blackout period for the May FOMC meeting ends.

Monday, May 5

- 09:45 AM S&P Global US services PMI, April final (consensus 51.2, last 51.4)

- 10:00 AM ISM services index, April (GS 49.8, consensus 50.3, last 50.8): We estimate that the ISM services index declined by 1pt to 49.8 in April, reflecting sequential softening in our non-manufacturing survey tracker (-1.1pt to 49.4 in April).

- 08:30 AM Trade balance, March (GS -$138.0bn, consensus -$136.7bn, last -$122.7bn): We estimate that the trade deficit widened to $138.0bn in March, reflecting higher imports ahead of tariff increases and a modest decline in travel exports as a result of foreign boycotts.

- There are no major economic data releases scheduled.

- 02:00 PM FOMC statement, May 6-7 meeting: We expect the FOMC to leave the fed funds rate unchanged at its May meeting and pushed back the first rate cut in our forecast to the July FOMC meeting (vs. June previously) after stronger-than-expected payrolls and ISM readings last week. As discussed in our FOMC preview, we expect Chair Powell to highlight that tariffs pose risks to both sides of the FOMC’s dual mandate goals of maximum employment and price stability. While the FOMC appears to be setting a higher bar for rate cuts than during the 2019 trade war, we do not think that high inflation would deter it from cutting if the unemployment rate begins to trend higher as the tariff shock hits the economy.

- 08:30 AM Nonfarm productivity, Q1 preliminary (GS -0.9%, consensus -0.7%, last +1.5%); Unit labor costs, Q1 preliminary (GS +5.2%, consensus +5.2%, last +2.2%);

- 08:30 AM Initial jobless claims, week ended May 3 (GS 225k, consensus 230k, last 241k): Continuing jobless claims, week ended April 26 (consensus 1,892k, last 1,916k)

- 11:00 AM New York Fed 1-year inflation expectations, April (last +3.58%); New York Fed 3-year inflation expectations, April (last +3.00%); New York Fed 5-year inflation expectations, April (last +2.86%): The New York Fed will release its measures of inflation expectations for April. The University of Michigan’s 12-month measure of inflation expectations increased by 1.5pp in April on the back of news about tariffs.

- There are no major economic data releases scheduled.

- 06:15 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a keynote address and will take part in a Q&A at the Reykjavik Economic Conference. Text and moderated Q&A are expected. On April 11th, Williams said that “the current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2 percent goal,” noting that it positions the FOMC “well to adjust to changing circumstances that affect the achievement of our dual mandate goals.”

- 06:45 AM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on artificial intelligence and the labor market at the Reykjavik Economic Conference. Text and Q&A are expected.

- 08:30 AM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will deliver a speech on maximum employment at the Reykjavik Economic Conference. Text and Q&A are expected. On April 22nd, Kugler said she supported “maintaining the current policy rate for as long as these upside risks to inflation continue, while economic activity and employment remain stable.”

- 10:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver opening remarks at a Fed Listens event in Chicago. On April 21st, Goolsbee said that the FOMC would want “to figure out the throughline” of where tariff policies ultimately settle, how much retaliation there will be, and how much impact the tariffs will have on supply chains “before we jump to action” on monetary policy.

- 11:30 AM New York Fed President Williams (FOMC voter) and Fed Governor Waller speak: New York Fed President John Williams and Fed Governor Christopher Waller will take part in a panel discussion titled “John Taylor and Taylor Rules in Policy” at the Hoover Institution’s Monetary Policy Conference. Text and Q&A are expected. On April 14th, Waller said he thought “monetary policy is meaningfully restricting economic activity” and that if high tariffs induce a slowdown that is “significant and even threatens a recession, then I would expect to favor cutting the FOMC’s policy rate sooner, and to a greater extent, than I had previously thought.” That said, Waller also noted that he would support “a more limited monetary policy response” in a smaller-tariff scenario with limited effects on inflation and growth.

- 07:45 PM St. Louis Fed President Musalem (FOMC voter), Cleveland Fed President Hammack (FOMC non-voter), and Fed Governor Cook speak: St. Louis Fed President Alberto Musalem, Cleveland Fed President Beth Hammack, and Fed Governor Lisa Cook will take part in a panel discussion at the Hoover Institution’s Monetary Policy Conference. Text is expected for President Musalem and Governor Cook’s remarks. Q&A is expected. On April 11th, Musalem judged that “monetary policy is currently well positioned given the state of the economy and the balance of risks.” On April 16th, Hammack noted that she would rather “be slow and move in the right direction than move quickly in the wrong direction.” And on April 5th, Cook noted that she placed “more weight on scenarios where risks are skewed to the upside for inflation and to the downside for growth,” and that those scenarios “could pose challenges for monetary policy.”

Tyler Durden

Mon, 05/05/2025 - 09:55

The post <a href=https://www.zerohedge.com/economics/key-events-week-all-eyes-fed-and-boe target=_blank >Key Events This Week: All Eyes On The Fed And BOE</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...