Guest Post by Peter Reagan

Worldwide, central banks now own more gold than U.S. federal debt. With $37T in debt, waning demand for our government’s debt and rising borrowing costs, the dollar’s decline is accelerating – and gold demand is soaring…

There’s a saying in Washington: Deficits don’t matter.

That line might work in speeches, but the rest of the world is quietly deciding otherwise.

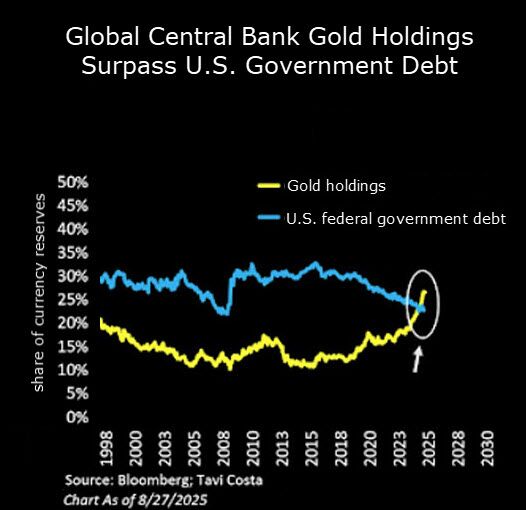

For the first time in three decades, official global gold reserves have surpassed holdings of U.S. federal government debt. (That same debt that’s called “the backbone of the global financial system,” the foundation of the dollar’s global reserve currency status.)

Central banks aren’t just hedging against dollar decline. They’re signaling they’d rather own physical gold bullion metal than lend to Uncle Sam.

This is not good news. Because global central banks have been a significant source of demand for our federal government’s debt for decades now…

What’s wrong with federal government debt?

First, let me say that the U.S. dollar is still by far the dominant currency for international transactions. The Federal Reserve wants to remind you that, “The U.S. dollar share of international payments is about 50 percent and has even slightly increased in recent years.”

So people are still using dollars for trade. They just aren’t stockpiling U.S. government debt. Why not?

Well, there are a few reasons…

- America’s national debt is over $37 trillion and still climbing

- And that number will keep rising – Washington plans to spend $7 trillion a year while only raising $5 trillion in revenue

- Weaponization of the dollar

- Our ongoing trade wars mean fewer dollars are flowing abroad, reducing the pool of foreign investors who have dollars to spend on our debt

- (Arguably the biggest reason) Over the last five years, on average, anyone who owned in federal government debt watched it lose about 24% of its value

The debt and ongoing deficits matter because more debt means reduced dollar purchasing power.

Why would anyone want to buy and hold an asset they know for certain is going to depreciate in value?

For all these reasons, it’s not hard to see why global demand for U.S. debt is waning.

This is happening at the worst possible time, though – just as the supply of federal government debt is exploding. (This is not an exaggeration, by the way! Over the last 30 days, on average, Treasury Secretary Bessent has sold about $23.4 billion in new government debt per day!)

Supply, demand and interest rates

When supply goes up and demand declines, what happens to price?

Price goes down. In government debt auctions, this results in higher borrowing costs. Investors demand larger interest payments to loan money to the U.S. government.

And that’s a problem, because the government’s borrowing costs are already the second-largest line item in the budget. Only Social Security costs more.

The more it costs to borrow money, the fewer dollars are available for everything else in the federal budget… Everything from defense to farm subsidies suffers.

Higher borrowing costs increase the pressure to borrow even more. It’s a vicious cycle.

“But wait,” regular readers are saying right now – “can’t the Fed just cut interest rates and save the day?”

You’re right to ask this question!

Unfortunately, the answer is no.

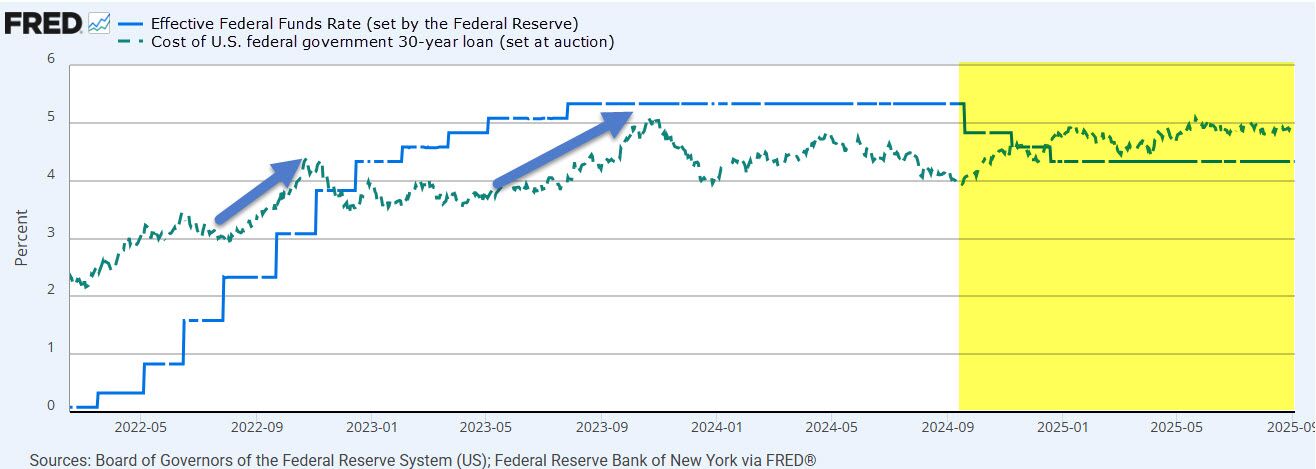

The interest rate the federal government pays to borrow money is set at auction. It’s not like eBay, not exactly – but the core dynamic is the same.

That means it’s not the Federal Reserve that controls U.S. government borrowing costs – but the lenders themselves.

Now, historically, the Fed’s interest rates and the cost of government borrowing tend to move together.

Not anymore. In fact, the last three times the Fed cut rates, the government’s long-term borrowing costs went up.

Take a look:

Global lenders simply refused to accept a lower rate to lend the government money.

“Unsustainable by definition”

This collision of rising debt supply and diminished demand leaves the White House with two grim choices. Here’s how billionaire investor Ray Dalio puts it:

“Allow interest rates to go up and have a debt default crisis, or print money and buy the debt that others won’t buy. Both paths would hurt the dollar.”

That’s the heart of the matter.

Either way, the dollar’s purchasing power continues to decline. Foreign lenders would experience this as “currency devaluation.” We see this same effect in the grocery store checkout line, and at the gas pump.

We call it “inflation.”

Different names for the same thing.

Dollar decline drives demand for gold

The rest of the world has clearly caught on to the federal government’s dilemma.

I’ve been telling you about the record levels of central bank gold buying (over 1,000 tons a year!) since 2022.

Now, maybe you can understand why.

And this is happening in spite of gold’s recent all-time high price. As Crescat’s Tavi Costa recently said:

“In 10 years from now, we’re going to look back and say, ‘wow, we were so stupid to think that gold prices now are close to a peak.’”

The message is simple: Dedollarization isn’t theory anymore. It’s happening. It’s happening despite high gold price.

Dedollarization is happening for reasons you can understand – simple economic reasons like “wealth preservation” and “hedging against dollar decline.”

Worse, it’s happening at the very moment our government’s debts are largest and their options for managing that debt are narrowest.

For everyday American families like yours and mine, that means one thing: Every paycheck, every retirement dollar, every bank account is tied to a currency that’s rapidly losing its global customers.

Today, central banks already own about 1/6th of all gold ever mined. And they’re not going to stop. In Costa’s words:

“Central banks are still in the early stages of accumulating gold and rebuilding their official reserves. There is no reason why gold can’t represent 80% of official reserves. What does this mean for gold prices? As central banks continue to buy gold, I would expect we will see prices at multiples of where they are now.”

That’s why so many people – from central bankers in Beijing to everyday folks in Boise — are diversifying their savings with physical gold. Physical precious metals are about the only financial asset that can’t be printed into existence. There’s only so much gold in the world.

And when the gold bullion sells out, nobody can print more ounces.

I strongly encourage you, regardless of your perspective on the future of the dollar, please consider the benefits of precious metal ownership – while you still can.

Ever notice how prices keep climbing but your paycheck stays flat? That’s what happens when more dollars chase the same goods. A physical gold IRA lets you own real metal that holds its value even as the dollar weakens. You get all the tax perks of an IRA plus the security of tangible assets you can count on. Click to grab your FREE Gold IRA info kit from Birch Gold Group and learn just how simple it is to add real metal to your retirement plan. And now introducing a Crypto IRA to capitalize on the fastest growing market in the world.