The Richest Colleges Are Fighting To Protect Their Endowments From Taxation

Before Donald Trump announced plans to cut $400 million from Columbia University, top U.S. colleges were already preparing to counter financial threats from his administration, according to a new report from Bloomberg.

The grant cancellation, citing alleged inaction against antisemitism, is one of several tactics Trump is using to pressure elite universities. These institutions also face potential tax hikes on their endowments and are actively working to block them.

Given they’re the institutions churning out pro-taxation far left radicals, kind of ironic, no?

Bloomberg writes that Harvard has hired a Republican-friendly lobbying firm, while Princeton’s president is spending more time in Washington to defend its $34.1 billion endowment.

MIT’s leader has made multiple trips to D.C., and a group of two dozen universities is holding Zoom meetings to strategize against financial threats.

Columbia says it is committed to combating antisemitism and hopes to restore funding, but Republicans continue targeting elite schools they view as prioritizing progressive values over meritocracy. The attacks pose an “existential threat” to colleges, according to the University of Pennsylvania’s president.

Private universities with large endowments argue the funds support scholarships, but critics question why wealthy institutions can grow billions tax-free.

Davidson College paid a $1.2 million endowment tax last year, which could have funded 15 full scholarships. Critics argue that same amount could have covered tuition for 300 community college students. Representative David Schweikert called university endowments “stunning” and questioned whether they truly serve students.

Davidson President Douglas Hicks is lobbying Congress to stop a tax expansion, warning it would hurt students. “If the goal is to make college more affordable, this is not an effective approach,” he said, noting Davidson meets 100% of financial need.

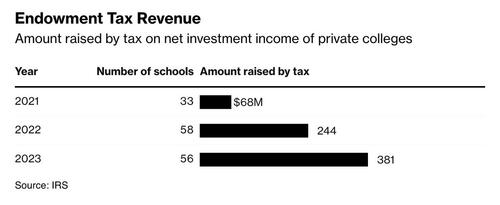

Colleges like Davidson fear becoming collateral damage in the GOP’s push to penalize elite universities over campus protests, as schools like Harvard, Stanford, and MIT freeze hiring amid potential federal funding cuts. Lawmakers are calling 2025 the Super Bowl of tax as they debate extending Trump’s 2017 tax overhaul, which introduced a 1.4% endowment tax on wealthy colleges, generating $380 million from 56 institutions in 2023.

Proposals from Trump and Vice President JD Vance suggest raising or expanding the tax, potentially lowering the threshold to $250,000 per student, which could impact smaller schools like Wabash College in Indiana.

Critics warn a higher tax could deter wealthy donors, redirecting money from students to the U.S. Treasury. Wabash President Scott Feller is also lobbying lawmakers, emphasizing that his school’s $430 million endowment is less than 1% of Harvard’s, yet faces the same tax burden.

Tyler Durden

Thu, 03/13/2025 – 18:50