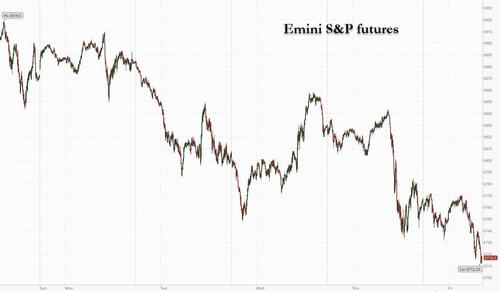

Stocks Slide To Session Lows As Risk Sentiment Fractures

US equity futs are trading at session lows driven by a tech-led dip in stock futures over the past two hours as global risk sentiment turns sour to end the week, and with Goldman TMT specialist Peter Bartlett observing that “a more bearish/skeptical view of the AI trade is coming up in more and more of our investor conversations… even if positioning hasn’t changed much off the highs.” As of 8:00am, S&P futures are down 0.5%, and Nasdaq futures drop 0.7%, with most of the Mag 7s underperforming (NVDA -0.7%, GOOG/L -0.5% and META -0.5%). Microsoft was poised for its longest losing streak since 2011. US Treasuries held onto yesterday’s gains with yields 1-2 bps higher after the two dismal labor reports . The dollar was steady, while Bitcoin headed for its worst week since March. Commodities are mixed; oil and precious metals are higher this morning, while base metals are lower. Macro headlines overnight were mostly quiet. Shutdown negotiation progress remains stalled; airline cuts begin this Friday. Chinese exports unexpectedly fall for the first time since February; Jensen Huang said he is not actively discussing the Blackwell shipment to China.

In premarket trading, Mag 7 stocks are mostly lower: (Tesla +0.1%, Microsoft -0.4%, Apple -0.04%, Amazon -0.6%, Meta -0.5%, Alphabet -0.7%, Nvidia -0.8%)

- Affirm Holdings (AFRM) jumps 10% after the buy-now-pay-later financing company raised its forecast for 2026 gross merchandise volume. The updated guidance beat the average analyst estimate.

- Airbnb Inc. (ABNB) rises 3% after issuing a better-than-expected outlook for the holiday quarter, with a recently launched “reserve now, pay later” feature helping fuel demand in the US.

- Applied Optoelectronics (AAOI) falls 13% after the maker of fiber-optic networking products reported third-quarter revenue that was slightly weaker than expected and gave a revenue outlook that was below the analyst consensus. However, analysts see strong prospects for 2026.

- Archer Aviation (ACHR) drops 11% after the company, which is trying to bring electric vertical takeoff and landing aircraft to market, said it is buying Hawthorne Airport in Los Angeles. The company is offering shares at $8 each to certain institutional investors to raise gross proceeds of $650m, part of which will be used to fund the acquisition.

- Block (XYZ) tumbles 14% after the fintech platform reported third-quarter adjusted earnings and net revenue that missed the average analyst estimate.

- Expedia (EXPE) rises 14% after the online travel agency’s results pointed to strong and resilient travel demand. Peer Airbnb (ABNB) also rallies after the company gave a better-than-expected outlook for the holiday quarter.

- Globus Medical (GMED) soars 28% after the medical-device maker increased its forecast for full-year profit following third-quarter earnings that topped estimates. Truist Securities upgrades to buy from hold, citing much higher earnings power following results.

- Intellia Therapeutics (NTLA) falls 30% after the biotech reported a patient died following treatment with its investigational gene-editing therapy to treat a rare disease.

- JFrog (FROG) soars 21% after the software company reported third-quarter results that beat expectations and raised its full-year forecast.

- KKR & Co. (KKR) is up around 5% after the investment company reported assets under management that beat the average analyst estimate. Fee-related earnings also came in above expectations.

- Microchip Technology (MCHP) falls 3% after the semiconductor-device company gave a weaker-than-expected revenue forecast.

- Monster Beverage (MNST) rises 4% after third-quarter results topped expectations. Analysts are positive about the energy drinks company’s gross margins and sales following the recent price hikes. Shares rose 4.1% in postmarket trading.

- Sandisk Corp. (SNDK) rises 3% after the computer hardware and storage company posted fiscal first quarter revenue that beat estimates. Second-quarter sales guidance also topped expectations. Analysts continue to see a strong AI-fueled tailwind for the company.

- Sweetgreen (SG) falls 13% after the restaurant chain cut its revenue guidance for the full year, missing the average analyst estimate. William Blair downgrades its rating on the stock.

- Take-Two Interactive Software Inc. (TTWO) falls 6% after delaying the release of Grand Theft Auto VI again, pushing back the much-anticipated video game by six months to November 2026.

- Wendy’s Co. (WEN) rises 7% after reporting that sales declined less than expected in the third quarter, a sign the burger chain is starting to rebound from a slump that’s eroded investor confidence this year.

In corporate news, Tesla shareholders approved a $1 trillion compensation package for CEO Elon Musk, more than 75% of the votes cast in favor of the largest payout ever awarded to a corporate leader. Comcast is said to explore Warner Bros Discovery Bid, and ITV confirmed discussions with Comcast’s Sky about a potential division sale.

Investors are heading into the end of a dizzying week that has delivered one of the toughest tests yet for the post-April AI-fueled rally amid growing doubts that the surge has gone too far. Futures edge lower in early trading, capping a week in which investors weighed concerns over tech valuations, sparse economic data, mixed signals on interest rate cuts and an unclear jobs market picture. With another empty Friday for labor economists, Fed commentary is drawing greater scrutiny. Austan Goolsbee said a lack of inflation data during the government shutdown makes him uneasy about continuing interest-rate cuts. That follows Beth Hammack’s caution that high inflation poses a bigger risk than job market weakness. John Williams sees Fed reserves as close to the desired level.

“Sentiment is probably modestly cautious,” said Karen Georges, a fund manager at Ecofi. “Any reassuring news on employment data in the US, a potential end to the shutdown, or tariff news-flow could give markets a new boost.”

With the US benchmark down 1.8% for the week, a notable feature has been the lack of clear catalysts behind the swings. Traders say the choppiness may linger for a while but expect it to remain relatively shallow, with solid earnings and the prospect of eventual Fed easing continuing to underpin sentiment.

“On the very short term, let’s say until the end of the year, we really don’t see any big correction on the horizon, we don’t see any type of catalyst for that,” said Arnaud Faller, chief investment officer at CPR Asset Management.

As noted last night, AI enthusiasm is increasingly meeting skepticism, with concerns centering on a question that threatens to undermine the hype: Who is going to provide all of funds needed to finance the lofty ambitions of OpenAI?

Opinions vary. DoubleLine Capital’s Robert Cohen warns on novel project structures, like off-balance sheet funding, and the uncertainty over whether such huge projects will make money. Delphine Arnaud, portfolio manager at Edmond de Rothschild, shares concerns over how quickly heavy capex can translate into earnings but doesn’t see a bubble-bursting scenario. Japan’s largest tech fund says AI stocks are not in a bubble and can rise further.

The silver lining: according to BofA, flows remain supportive with US equity funds attracting $19.6 billion for the week ending Nov. 5, an eighth consecutive week of inflows. That said, volatility gauges remain in focus with the VIX index back above 20 briefly on Thursday, and the VVIX rose at one point to the highest since mid-October.

Semiconductors remain in the spotlight. Nvidia isn’t in active discussions to sell its Blackwell AI chips to Chinese firms, said CEO Jensen Huang. The Netherlands is prepared to suspend its powers over Chinese-owned chipmaker Nexperia if China allows exports of its critical chips again.

Turning to earnings, out of the 448 S&P 500 companies that have reported so far in the earnings season, 82% have managed to beat analyst forecasts, while 14% have missed. KKR, Franklin Resources, Duke Energy and Constellation Software are among companies expected to report results before the market opens. Analysts will be listening for Duke Energy details on new large-load customers like data centers as well as the utility’s plan for financing its rising capital expenditures.

European stocks reverse an opening rise, with the Stoxx 600 falling 0.4% on a drag from travel, insurance and tech stocks. Novo Nordisk shares dropped after the Danish drugmaker increased its offer for Metsera Inc. The media and autos sectors outperformed, while travel and leisure shares lagged, dragged lower by IAG. Here are some of the biggest movers on Friday:

- Euronext shares rise 3% on third-quarter profit beat, improved cost guidance for the full year and a €250 million share buyback.

- ITV shares surge as much as 18% in London trading, after the broadcaster announced Sky’s owner Comcast is in preliminary discussions about a potential acquisition of its media and entertainment division.

- Monte Paschi shares rally as much as 5% to be the best performers on the Stoxx 600 Banks Index on Friday, after the Italian lender reported net income for the third quarter that beat the average analyst estimate.

- Amadeus shares rise as much as 4%, the most since July, after the company reported results that topped expectations in the third quarter.

- Arkema shares rise as much as 6.5%, the most since May, after the French chemicals company released earnings and lowered its guidance as expected.

- Aumovio shares rise as much as 6.5% after the auto parts supplier posted earnings ahead of expectations in the third quarter, despite a challenging sales backdrop.

- SBB shares advance as much as 13% after the Swedish landlord delivered net income of 803 million Swedish kronor ($83.8 million) for the third quarter.

- Novo Nordisk shares drop as much as 2.3% after the Danish drugmaker said it expects a negative low single-digit impact on global sales growth in 2026 following Thursday’s deal with the Trump administration.

- Rightmove shares fall as much as 28% after the UK online property portal announced plans to step up investment in artificial intelligence, which analysts said will reduce profit estimates for 2026 onward.

- IAG shares drop as much as 9.8%, the most since April, after reporting a miss on Ebit in the key third quarter.

- Dino Polska shares drop as much as 10% after the company reported EPS and sales below estimates on Thursday.

Earlier in the sesssion, Asian stocks fell, with technology-heavy markets leading the decline, as concerns about swelling valuations put the regional gauge on track for its worst week in three months. The MSCI Asia Pacific Index dropped as much as 1.3% on Friday, set for its worst week since August. Markets with large technology weightings, such as Japan, South Korea and Taiwan, tracked declines in US peers, while Hong Kong also slipped and China’s benchmarks closed lower. Indonesia advanced, and Indian equities trimmed most of their earlier losses. Tech stocks will continue to be in focus for the week ahead, with several firms in the region reporting earnings including Tencent, SoftBank and Sony. India will also report inflation figures, while Hong Kong and Malaysia will release gross domestic product data.

In FX, the dollar strengthens against most G-10 currencies, with the yen, kiwi and sterling underperforming. Fed rate-cut bets into 2026 following hawkish comments from Goolsbee and Hammack.

In rates, bonds falling, with 10-year Treasury yields up two basis points and declines across Europe and the UK. Investors trimming

Treasury futures trade off session lows leading into the US session, with yields still slightly higher on the day across the curve. US long-end yields are about 1bp cheaper on the day, steepening the curve by less than 1bp; 10-year near 4.09% also is about 1bp higher on the day, outperforming UK counterpart by about 2bp, Germany’s by about half a basis point. IG dollar issuance slate empty so far and expected to be sparse. Thursday’s $9.7 billion haul brought weekly total to $55 billion, matching dealers’ projections. Focal points of US session include November preliminary University of Michigan sentiment, with October jobs report expected to be delayed due to the government shutdown.

In commodities, gold rose and hovered around $4,000/oz. Oil prices rallying with Brent futures above $64/barrel.

The US economic calendar includes University of Michigan sentiment (10am), October NY Fed 1-year inflation expectations (11am) and September consumer credit (3pm). October jobs report would ordinarily appear at 8:30am. Fed speaker slate includes Governor Miran (3pm)

Top Overnight News

- About 700 flights today were canceled by the four biggest US airlines as the government ordered reduced operations. Trump’s administration finalized flight cuts to start at 4% on Friday and will ramp up to 10% on November 14th: BBG

- VP JD Vance said Americans are about to start suffering some very real consequences because of the government shutdown.

- Senate Majority Leader John Thune will attempt to move legislation in the Senate on Friday that could lay the groundwork for reopening the government, although Democrats look like they could block this measure. Politico

- The Trump administration moved to appeal the judgement requiring full SNAP benefits to be paid by Friday.

- The European Commission is proposing a pause to parts of its landmark AI laws amid intense pressure from Big Tech companies and the US gov. Brussels is set to water down parts of its digital rule book, including its AI at that entered into force last year, in a decision on a so-called simplification package on Nov 19. FT

- Nvidia CEO Jensen Huang said his company isn’t in active discussions to sell its Blackwell AI chips to Chinese firms, waving off speculation it’s trying to engineer a return to that market. BBG

- China has begun designing a new rare earth licensing regime that could speed up shipments, but it is unlikely to amount to a complete rollback of restrictions as hoped by Washington, industry insiders said. RTRS

- China’s exports fell in October, with shipments to the U.S. dropping for a seventh straight month, as the growth that has powered the world’s second-largest economy this year took an unexpected stumble. Exports came in at -1.1% (vs. the Street +2.9%) and imports +1% (vs. the Street +2.7%). WSJ

- German exports rose in September, helped by a bump in trade with the U.S. after the European Union agreed to a deal on tariffs in the summer. Exports +1.4% (vs. the Street +0.5%) and imports +3.1% (vs. the Street +0.5%)

- Ukraine’s ambassador to the US Olha Stefanishyna said there have been “positive” talks on acquiring Tomahawk missiles, despite Trump’s reluctance. BBG

- NY Fed President John Williams said that the Federal Reserve could soon return to expanding its securities holdings, a week after the central bank said that it would wind down efforts to shrink its balance sheet on Dec. 1. The net bond purchases would be the next, long-planned phase of the Fed’s approach to matching the levels of cash-like assets available to banks to their needs—not a new effort to stimulate the economy. WSJ

- The longest US government shutdown in history isn’t driving the recent softening in markets, but still, they aren’t holding up as well as they did during 2018-2019, according to Bloomberg Intelligence. And missing paychecks and data delays may make the situation worse. BBG

- US Justice Department is said to be investigating the DC mayor over a foreign trip, according to The New York Times.

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.5%

- DAX -0.6%

- CAC 40 -0.3%

- 10-year Treasury yield +2 basis points at 4.1%

- VIX +0.8 points at 20.28

- Bloomberg Dollar Index little changed at 1222.16

- euro unchanged at $1.1547

- WTI crude +1.4% at $60.26/barrel

Trade/Tariffs

- US President Trump posts that he’s thrilled to announce an incredible trade and economic deal between the US and Uzbekistan in which the latter will be purchasing and investing almost USD 35bln over the next three years, and more than USD 100bln in the next 10 years in key American sectors, including critical minerals, aviation, automotive parts, infrastructure, agriculture, energy & chemicals, information technology, and others.

- US is to block NVIDIA’s (NVDA) sale of scaled-back AI chips to China, according to The Information.

- Netherlands is said to be ready to drop control of Nexperia if chip supply resumes, according to Bloomberg.

- China has begun working on rules to ease rare earth export curbs, according to Reuters citing industry sources.

- China’s Commerce Ministry suspends more rare earths related export control measures.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower as the region took its cue from the risk-off mood stateside, where sentiment was weighed on by weak US labour market proxies and AI concerns, while sentiment was also not helped by weak Chinese trade data. ASX 200 was led lower by weakness in tech and the top-weighted financial industry, with the latter pressured as Macquarie shares retreated on earnings disappointment. Nikkei 225 briefly fell beneath the 50,000 level after recent tech woes, currency strength and disappointing Household Spending data. Hang Seng and Shanghai Comp conformed to the downbeat mood after the PBoC’s open market operations resulted in the largest weekly drain since early 2024 and as participants awaited Chinese trade data which ultimately showed a surprise contraction in exports, while it was also reported that the US is to block NVIDIA’s sale of scaled-back AI chips to China.

Top Asian News

- PBoC injected CNY 141.7bln via 7-day reverse repos with the rate kept at 1.40%, while its operations resulted in a weekly net drain of CNY 1.57tln which is the largest fund withdrawal since January 2024.

European bourses (STOXX 600 -0.3%) opened with a slight positive bias, but slipped soon after the cash open to display a mostly negative picture in Europe. Initial strength perhaps a cooling from the prior day’s pressure, but ultimately conformed to the subdued APAC session overnight. European sectors began the day with a positive bias, but now mixed. Autos takes the top spot, following modest post-earning upside in Daimler Truck (+0.9%, poor results but sees strong EBIT). Moreover, Netherlands is said to be ready to drop control of Nexperia if chip supply resumes, according to Bloomberg – further boosting sentiment for the sector. To the downside, IAG (-7%) tumbles after it noted that Transatlantic weakness hit sales.

Top European news

- Citi on the BoE, after November’s meeting, cautiously brings back the call for a December cut, but highlights the two sets of data and the budget before then as points of uncertainty.

FX

- DXY has recovered a portion of the prior session’s losses but remains capped below the 100.00 handle, with the rebound tempered by a combination of soft US data and renewed trade-related concerns. The greenback came under pressure yesterday following a trifecta of weak labour market proxies, underscoring signs of cooling momentum in the US economy. Additionally, reports that Washington is set to block NVIDIA’s sale of scaled-back AI chips to China introduced a fresh layer of trade-related risk. On the Fed, Williams avoided remarks on near-term policy. Ahead, on the data front, Prelim University of Michigan sentiment data for November is likely to see the headline slip to 53.2 from 53.6, conditions rise to 59.2 from 58.6. DXY is consolidating modestly above recent lows, with the index last around the 99.85 mark and well within Thursday’s hefty 99.67-100.11 range.

- EUR/USD found resistance at 1.1550 but is holding above the 1.15 handle, retaining the bulk of its recent gains following the USD’s broader retracement. Germany’s trade surplus this morning narrowed to EUR 15.3bln in September (exp. 16.8bln, prev. 17.2bln), with no notable move seen in the EUR. EUR/USD remains marginally within Thursday’s 1.1490-1.1552 range in a current 1.1530-1.1551 band.

- JPY is the clear laggard across the G10 space, retracing a portion of yesterday’s haven-driven gains. Overnight price action was choppy, with USD/JPY oscillating around the 153.00 mark amid a mix of lingering safe-haven demand and softer domestic data, as Japan’s Household Spending figures disappointed expectations. The pair now trades toward the upper end of a relatively contained 152.81–153.54 intraday range, compared to Thursday’s broader 152.83–154.14 parameters. Overall, price action suggests consolidation rather than fresh directional impetus.

- GBP/USD has eased modestly after yesterday’s advance, which came despite the BoE’s dovish hold and was largely driven by broader USD weakness. The pair briefly dipped below the 1.31 handle (low at 1.3097) after touching a session high of 1.3142, marking a retracement from yesterday’s BoE-day range of 1.3042–1.3142. On the domestic front, Halifax data painted a firmer picture of the UK housing market, with prices rising +0.6% M/M in October (exp. +0.1%, prev. -0.3%), pushing annual growth to +1.9% Y/Y (prev. +1.3%). Fiscal headlines also drew attention, with reports that Chancellor Reeves told the Budget watchdog she intends to raise income tax as part of efforts to repair the public finances. Further speculation points to a potential 2p income tax increase paired with a targeted 2p National Insurance cut, alongside consideration of narrowing NI relief above GBP 50,270 and a possible reduction in the annual cash ISA allowance to GBP 12,000 (previously touted GBP 10,000 and from current GBP 20,000).

- Antipodeans are mixed today with the Aussie winning on the AUD/NZD cross, benefiting from stronger copper prices despite weak Chinese trade data. In brief, Chinese exports unexpectedly slipped for the first time since October; but it is worth caveating that the prior month surprised to the upside which captured some front-loading ahead of the Trump-Xi meeting, which has since passed without issue.

Fixed Income

- A contained start to the session for USTs but there is a modest bearish bias owing to the slightly constructive trade in US equity futures, though magnitudes are modest. A lot of Fed speak in recent trade. This morning, Williams spoke at an ECB conference, discussing reserve management bond buying as a technical operation. Ahead, we have remarks from Miran (voter) once again and Jefferson (voter). Jefferson, the more interesting of the two, as he generally has a dovish stance, so it will be pertinent to determine if his bias remains the same or has moderated, in the context of Powell’s hawkish press conference. Jefferson last spoke at the start of October and said that while not having BLS data was less than ideal, there was enough information to do the job and was confident in reaching the inflation target. Thus far, USTs in a 112-22 to 112-28 band notching downside of just 4+ ticks at most, comfortably within Thursday’s 112-10 to 112-30 confines.

- Bunds also experienced a slightly softer start to the day, as outlined above. Early doors, a strong set of German trade data for September sent Bunds to a 129.02 low. A strong series that bodes well for the German recovery narrative and follows on from a rebound in industrial production data for the September period (as expected). Nonetheless, the narrative for Germany remains one of structural weakness, but with some signs of a recovery emerging. Since, the move has extended marginally to a 128.99 base, matching the trough from Thursday and in reach of Wednesday’s WTD 128.96 low.

- Gilts opened on the backfoot, posting losses of just over 10 ticks before slipping further to a 93.10 low. If the move continues, we look to Thursday’s 93.03 WTD base. The pullback today comes after the upside seen on Thursday by the BoE, as while desks are aligning around a December cut as being the emerging base case, that view is contingent on the two sets of data and budget due before the December meeting. BoE’s Bailey due to speak once again today, though he is unlikely to add much vs his presser and subsequent media rounds on Thursday; full Newsquawk review available on the headline feed. Elsewhere, the budget remains in focus and an increase to income tax is now very likely following a Times article that Chancellor Reeves has reportedly told the watchdog she intends to increase the measure. She is reportedly considering a 2p increase to income tax and a 2p cut to NI, echoing reports on the weekend that suggested as much, in a bid to move the burden away from workers and onto other groups.

Commodities

- Crude benchmarks have reversed Thursday’s losses as risk sentiment continues to shift amid AI concerns and weak US labour market. WTI and Brent oscillated in a tight c. USD 0.20/bbl for the majority of the APAC session before bidding higher and remaining near session highs as European trade continues.

- After Thursday’s choppy price action, spot XAU has continued to grind higher throughout APAC trade and into the European session. XAU started the day at USD 3977/oz and bid higher straight from the open to a peak of USD 4003/oz before pulling back slightly to a low of USD 3985/oz. As the European session got underway, the yellow metal has extended higher and is currently trading at session highs at USD 4010/oz.

- Base metals are trading rangebound as the European session gets underway, and as it steadies from Thursday’s risk-off environment. 3M LME Copper continues to oscillate in a tight USD 10.68k-10.75k/t band as the market awaits a new catalyst.

- Chinese Securities Regulator approved registration of platinum and palladium futures and options.

- Morgan Stanley says new projects successfully coming online in H1-2026 will be the catalyst for Dutch TTF to move below EUR 30/MWh by H2-2026.

Geopolitics

- US President Trump said Iran has been asking if US sanctions can be lifted, while he responded ‘very soon’, when asked when the international stability force for Gaza will be on the ground.

- US President Trump said he held a great call with Israeli PM Netanyahu and Kazakhstan’s President Tokayev, while Trump noted that Kazakhstan is the first country of his second term to join the Abraham Accords and the first of many, with more nations lining up to embrace peace and prosperity through my Abraham Accords.

- Ukrainian ambassador said her country is engaged in “positive” talks about buying Tomahawk missiles and other long-range weapons

- US Senate voted 51-49 to block a measure barring US President Trump from launching war on Venezuela.

- Japan’s government said North Korea fired what could be a ballistic missile which fell shortly after, while Japanese PM Takaichi said North Korea’s missile likely fell outside of Japan’s exclusive economic zone.

US Event Calendar

- 10:00 am: Nov P U. of Mich. Sentiment, est. 53, prior 53.6

- 3:00 pm: Sep Consumer Credit, est. 10.23b, prior 0.36b

- 7:00 am: Fed’s Jefferson Speaks on AI and Economy

- 3:00 pm: Fed’s Miran Speaks on Stablecoins and Monetary Policy

DB’s Jim Reid concludes the overnight wrap

Although the market feels a bit tired at the moment I’m positively bouncing this morning as last night was the first time in a couple of weeks that I haven’t woke up around 2-3am in pain after my recent back operation. However if you really want to understand pain, last night I was trying to teach two 8-yr olds decimals. It was 99.999999% excruciating.

In a parallel universe, and one where I don’t have to teach Maths, we would this morning be eagerly awaiting the US payrolls report later today. But with its extended absence from the calendar, the past couple of days have seen outsized market reactions to second-tier US employment data that would normally serve as the amuse-bouche to today’s main event.

Wednesday saw a sharp yield sell-off following a solid ADP employment report and then better ISM services data. However, that move was completely reversed yesterday after a weak US job cuts release, with the 10yr Treasury yield falling -7.6bps — its biggest daily decline since the US-China trade escalation on October 10. This triggered a global risk-off move, with the S&P 500 down -1.12%, the Nasdaq off -1.90% and the Stoxx 600 -0.70%. Pricing of a Fed rate cut in December rose to 70% (+8pp on the day).

Starting with the US data, investors were rattled by the Challenger, Gray & Christmas report showing October job cuts up +175.3% year-on-year, totalling 153,074 — the highest October figure since 2003. Meanwhile, Revelio Labs’ payroll estimate dropped -9.1k, driven largely by -22.2k losses in government employment. These figures contrasted with Wednesday’s more upbeat ADP and ISM services data than expected.

The backdrop led to a strong rally in Treasuries, with the 10yr yield down -7.6bps to 4.08%, and similar declines for the 2yr (-7.6bps) and 30yr (-5.8bps). Normally, private data prints don’t move markets this much, but the government shutdown has amplified their impact. Equities saw broad declines, with the Russell 2000 down -1.86%, the S&P 500 -1.12%, and the Nasdaq -1.90%. The Magnificent 7 dropped -2.02%, led by Nvidia’s -3.65% decline while Tesla fell -3.50%. The latter move came before Tesla’s shareholders approved Elon Musk’s new pay package yesterday evening. This could reach a remarkable $1 trillion if Tesla hits all the maximum milestones that include a more than quintupling of its market cap to $8.5trn.

While the equity losses were more modest outside of tech, other risk assets also struggled, with US HY credit spreads rising +7bps, while Bitcoin sunk -2.49%. The VIX volatility index briefly moved above the symbolic 20 level before ending the day at a three-week high of 19.50 (+1.49pts on the day).

Central bank pricing was also affected, with futures raising the probability of a December rate cut to 70%, up from 62% the day before. Looking further out, the number of cuts priced by December 2026 rose +8.2bps to 85bps, weakening the dollar index by -0.47%. These moves came despite hawkish-leaning remarks by Fed officials. Chicago Fed President Goolsbee noted labour market stability and expressed caution about further rate cuts given the lack of inflation data due to the shutdown. Cleveland Fed President Hammack again struck a hawkish tone, focusing on inflation risks and suggesting that the Fed’s stance was “barely restrictive”. St Louis Fed President Musalem similarly said the policy was now “somewhere between modestly restrictive and neutral”.

With all the uncertainty around the state of the US economy, it’s interesting to highlight a couple of the latest reports by our economists that go against some of the prevailing narratives. In the first (see here), our Chief US Economist Matt Luzzetti finds that labour market data do not support the narrative of labour hoarding as a driver of the recent low firing regime. In the second (see here), Peter Sidorov looks at the two-speed US economy through the lens of the credit cycle and argues that the underperforming rate-sensitive sectors are more likely to see improvement than further deterioration over the coming quarters. So food for thought.

Turning to the US shutdown, hopes for resolution swung back and forth over the past 24 hours. Senate Majority Leader John Thune has proposed a Senate vote today on a new continuing resolution that would re-open the government through January. According to reports, this would include a three-bill spending package covering some items that have been negotiated with Democrats but not the extension of expiring health subsidies. Politico reports that Democrats are expected to block today’s procedural vote, seeing Tuesday’s weak election performance by the Republicans as reducing the need to rush to give up negotiating power. Still, it’s a developing story to watch today and into the weekend. Polymarket currently assigns a 55% chance of resolution by November 15, and a 93% chance by November 30.

Over in Europe, the BoE held rates at 4% as expected, but the decision was more dovish than anticipated. The vote split 5-4, with four members favouring a 25bp cut. Governor Bailey noted that September’s 3.8% inflation was “likely to be the peak.” Our UK economist highlights that the BoE’s forward guidance now states that “if progress on disinflation continues, Bank Rate is likely to continue on a gradual downward path,” with the word “careful” removed, which had been there alongside “gradual”. See our economist’s review of the meeting here and updated views. Gilt yields fell across the curve, with the 10yr down -2.9bps, a larger move than seen in European peers.

Elsewhere in Europe, equities declined amid weak data and some renewed concerns about France. Euro Area retail sales for September fell -0.1% (vs. +0.2% expected), German industrial production rose +1.3% (vs. +3.0% expected), and UK construction PMI came in at 44.1 (vs. 46.9 expected). This contributed to the risk-off tone, with the STOXX 600 down -0.70%, the DAX -1.31%, the FTSE 100 -0.42%, and the CAC 40 -1.36%. Bond yields followed suit, with 10yr bunds (-2.3bps), OATs (-1.1bps), and BTPs (-1.1bps) all lower.

Asian markets opened very weak this morning but are recovering a bit as I type with US futures edging higher. The Kospi (-2.06%), Nikkei (-1.71%), Hang Seng (-0.92%), and S&P/ASX 200 (-0.66%) are all in negative territory but above their low. Mainland Chinese equities are fairly flat even as China’s exports contracted unexpectedly, with yoy exports at -1.1% (vs. +2.9% expected) and yoy imports at +1.0% (vs. +2.7% expected). Electrical exports were down -8% mom which hints at the fact that we might be seeing payback for earlier front loading ahead of tariffs. Mainland Chinese equities have clawed back earlier losses to be broadly flat though. S&P 500 (+0.20%) and Nasdaq (+0.28%) futures are recovering this morning and 10yr USTs are back up +1.5bps to 4.10%.

Looking ahead today, data releases include Germany and France’s September trade balances, and Canada’s October employment report. Central bank speakers include the Fed’s Williams, Jefferson and Miran, the ECB’s Nagel and Elderson, and the BoE’s Pill. Earnings releases include Constellation Energy and KKR.

Tyler Durden

Fri, 11/07/2025 – 08:48