SEC’s Gensler Hints At Quitting, Defends Crypto War, Sued By 18 States For “Gross Gov’t Overreach”

It was a busy day for SEC Chair Gary Gensler…

With bitcoin smashing to new record highs after Trump’s trifecta victory, Gensler – potentially only weeks away from being removed from office – appeared to double-down on his position on (predominantly negative) crypto policy and enforcement.

As CoinTelegraph’s Turner Wright reports, in prepared remarks for a Nov. 14 speech at the Practicing Law Institute’s 56th Annual Institute on Securities Regulation, Gensler said his focus for digital assets while leading the commission was having parties “register and give proper disclosure to the public” for roughly 10,000 tokens considered securities.

He also pointed to the SEC’s record of approving spot Bitcoin BTC$88,160 exchange-traded funds and BTC futures investment vehicles under his watch but suggested that some crypto firms had not followed “common-sense rules of the road.”

“This is a field in which over the years there has been significant investor harm,” said Gensler.

“Further, aside from speculative investing and possible use for illicit activities, the vast majority of crypto assets have yet to prove out sustainable use cases.

Everything we’ve done is focused on ensuring compliance with our laws.”

Though the SEC chair’s term ends in June 2026, Trump promised crypto users that he intended to fire Gensler “on day one” if elected, marking a potentially different direction the commission could take on crypto enforcement.

Experts have suggested that the president-elect could not remove Gensler without cause, nor has the SEC chair suggested he would resign.

It’s unclear if Trump has the authority to remove Gensler from the SEC. Any replacement would require Senate approval, but the Republican suggested he would attempt to bypass the chamber by making recess appointments for all of his cabinet and staff. At the time of publication, Trump had not announced any potential replacement for Gensler.

But, at the end of the prepared remarks, Gensler dropped a statement that sounded a lot like a ‘so long and thanks for all the fish’ comment:

Remarkable SEC Staff

Before I close, I want to say something about the SEC and its staff. It’s a remarkable agency. The staff and Commission are deeply mission- driven, focused on protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.

The lawyers, accountants, economists, policy experts, and other staff generally could make more money working somewhere else. They choose, though, to work on behalf of the public here at the SEC.

It’s been a great honor to serve with them, doing the people’s work, and ensuring that our capital markets remain the best in the world.

Conclusion

Sam and Jane Gensler, my mom and dad, never worked in finance or even completed college. When they invested their savings, our family benefited from the securities markets’ common-sense rules of the road.

The SEC’s effective administration of well-regulated securities markets promotes trust. It’s what brings investors and issuers to the market like fans to a football game. It’s what underpins the world’s largest capital markets. It’s what has contributed to our nation’s great economic success these last 90 years.

I’ve been proud to serve with my colleagues at the SEC who, day in and day out, work to protect American families on the highways of finance.

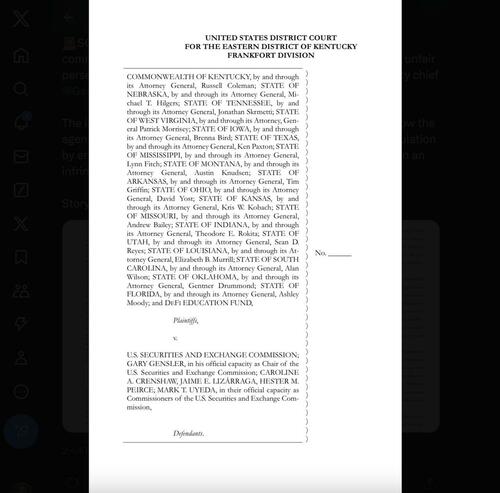

But things then went a little bit turbo for Liz Warren’s enforcer as CoinTelegraph’s Vince Quill reports that 18 US states have filed a lawsuit against the Securities and Exchange Commission (SEC) and Chairman Gary Gensler, accusing the financial regulator of “gross government overreach” against the nascent crypto industry.

The plaintiffs include Nebraska, Tennessee, Wyoming, Kentucky, West Virginia, Iowa, Texas, Mississippi, Ohio, Montana, and others.

The legal complaint reads:

“The Securities and Exchange Commission (SEC) has not respected this allocation of authority.

Instead, without Congressional authorization, the SEC has sought to unilaterally wrest regulatory authority away from the States through an ongoing series of enforcement actions.”

According to the Blockchain Association, the Securities and Exchange Commission’s various legal actions against the crypto industry cost crypto firms a collective $426 million bill to fight against the regulatory agency’s enforcement actions and lack of clarity on a coherent digital asset policy.

Buh-bye, Gary!

An open ‘Goodbye’ to #GaryGensler pic.twitter.com/VtjGJT0Vfb

— Vote Orange (@_Vote_Orange_) November 13, 2024

Tyler Durden

Thu, 11/14/2024 – 17:00