Direct from BOOM Finance and Economics

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

Once these basic monetary facts are known and understood, it makes sense to watch closely for excessive growth in private debt as a warning sign that an economy is getting overheated and will soon reach limits to growth. Conversely, if private debt, as a percentage of GDP, is falling over time in an economy, it is evidence of economic weakness that will eventually manifest in either contraction or stagnation.

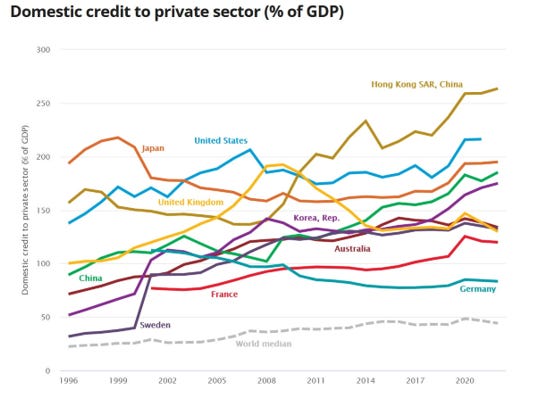

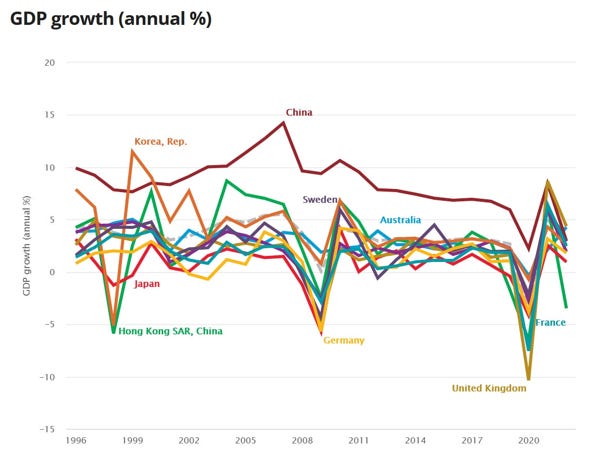

This hypothesis can be tested with data provided by the World Bank. This chart shows Domestic Credit in the Private Sector as a Percentage of GDP over time from 1996 to 2022. The nations on display are all large, advanced economies well above the global median (the dotted grey line at the bottom of the chart). Examination of the chart reveals some rather shocking conclusions.

United States (2021) – 216% (stagnant from 2006 to 2019 then rising) China – 185% (steady upward trend except through the years 2003 – 2008) Japan – 195% (falling from a peak in 1999. Some resurgence from 2018) Republic of South Korea – 175% (generally rising throughout the entire period) Australia — 134 % (generally rising until a fall from Covid in 2020 – 2022) Sweden — 132% (generally rising until a fall from Covid in 2020 – 2022) United Kingdom – 130% (rising strongly to a peak in 2008 then falling strongly) France — 120% (generally rising until a fall from Covid in 2020 – 2022) Germany – 83.4% (falling consistently for 20 years from 2001 — 2022)

Three nations registered falls in private credit growth from 2020 to 2022 no doubt due to the Covid Panicdemic. They were Australia, Sweden and France. Hong Kong, China and South Korea have seen steady growth in private credit which indicates that the internal dynamics of their economies appear intact.

However, all three are mercantilist economies depend upon strong external demand for their exports. At the end of 2022, Hong Kong was clearly over heating in its creation of credit at unsustainable levels. As expected, due to its aging demographics, Japan’s growth in private credit has fallen steadily from its peak in 1999. However, there was some resurgence in growth from 2018-22.

The United States performance in private credit growth may be a little surprising to some readers. It was badly damaged by the severe 2008 Banking Crisis (caused by rampant US bank fraud). Private Credit as a percentage of GDP fell sharply from 2007 to 2011 then stagnated until 2018. That is 10 years of poor private credit growth from the largest national economy on Earth. It reveals just how bad the fraud was in the US banking sector leading up to 2007/2008.

Where were the banking sector regulators prior to 2008? Were they incompetent or were they captured to such an extent that they failed to regulate? However, since 2018, US private credit growth resumed growing to 2022.

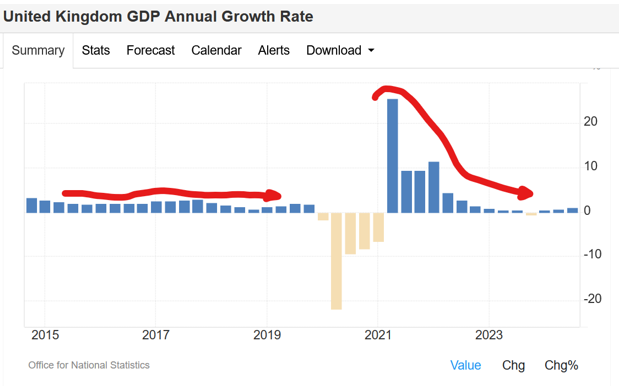

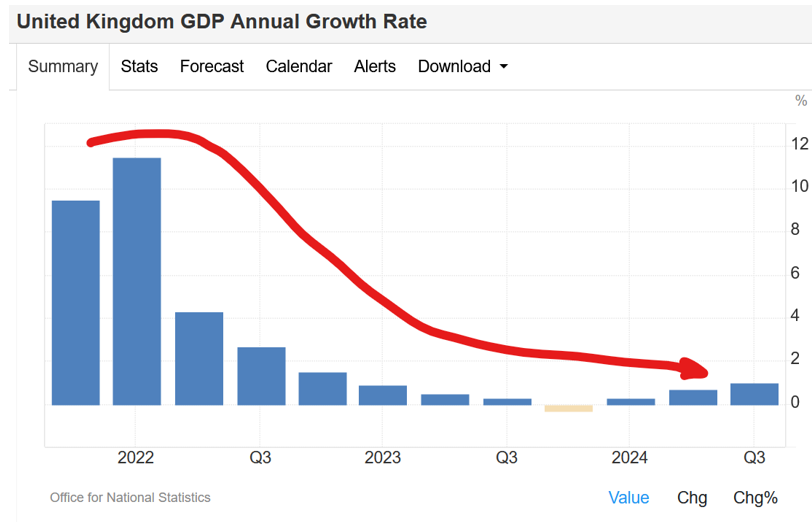

The United Kingdom peaked in private credit growth way back in 2008 and has been in strong decline ever since. This indicates that the UK economy is in dire straits indeed. There appears to be little hope for the UK to resume strong economic growth if this trend continues.

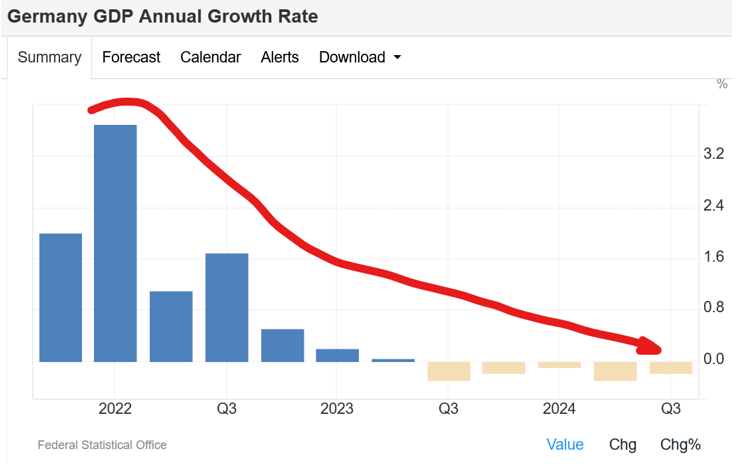

The other nation that surprises is Germany with persistent declines in private credit growth since 2001. That is over 20 years of no growth in private credit as a percentage of GDP and is a disastrous result. Germany and the UK seem to have major economic problems that are not being recognised and corrected by their governments. In BOOM’s opinion, this shows a complete failure from their political class to manage their nations. These nations lack quality leadership. That is strikingly obvious.

One further comment on US bank regulation: Bank regulation in the United States is highly fragmented compared to other G10 countries, where most countries have only one bank regulator. In the US, banking is regulated at both the federal and state level. Depending on the type of charter a banking organisation has and on its organisational structure, it may be subject to numerous federal and state banking regulations.

Apart from the bank regulatory agencies the US maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike other major advanced economies (where regulatory authority over the banking, securities and insurance industries is combined into one single financial-service agency).

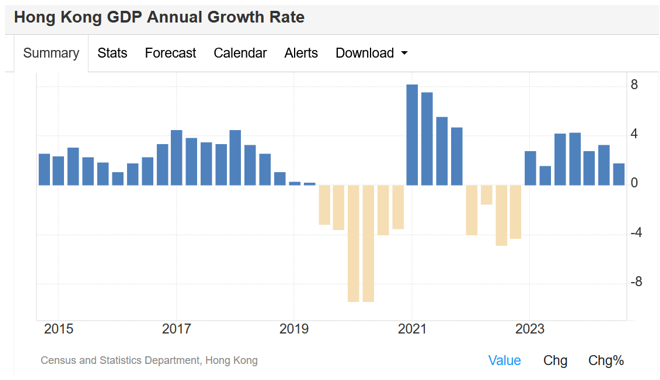

It is now time to examine what has happened to these 10 nations in regard to their GDP Growth. Let’s look first at the ones with strong private credit growth as a percentage of GDP. The three top nations are Hong Kong, the USA (both with private credit above 200% of GDP) and China at 185%. HONG KONG SUFFERED TWO MAJOR RECESSIONS

Hong Kong’s private credit growth appeared very overheated in 2022. Clearly, this was a sign of potential economic danger. Hong Kong’s economy contracted badly during the Covid event with its Annual GDP Growth crashing to negative 10% for two quarters in 2020. It rebounded in 2021 (as did almost all economies in a reversion to the mean). However, it crashed into recession again for the whole of 2022.

The chart shows 4 quarters of negative GDP growth in that year. There has been a resurgence in 2023 and 2024. However, it warrants close inspection going forward. Economic fragility seems baked into the cake here with excessive private debt one of the possible causes. Excess growth in Private Credit seems to have harmed Hong Kong’s real economy. It was not resilient to the impact of the Covid disruption.

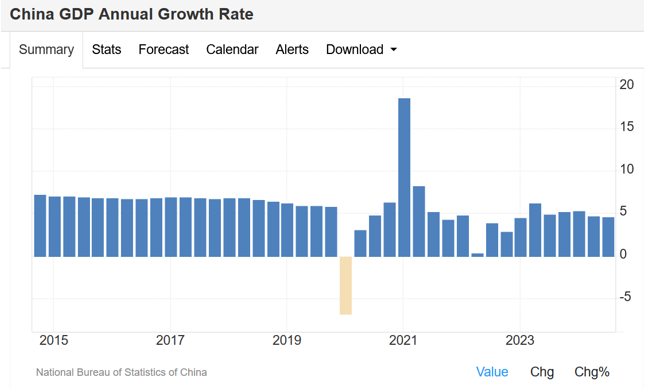

China’s annual growth in GDP was extraordinary from 1996 at 10% right through to a peak of almost 15% in 2007. However, it did not escape the impact of the Global Financial Crisis in 2007-08. Banking fraud in the USA clearly had a global economic effect.

Since 2007, China’s annual growth in GDP fell each year (with one exception) to a low of 2.34% in 2020 during the Covid Panicdemic. However, it did not register an economic recession. Since then, it rebounded to 8.45% in 2021. In 2022, it fell again to 2.99%. However, since then, China’s Annual GDP Growth has averaged around 5% in 2023 and during 2024. That is a remarkable achievement.

However, since 2022, things have changed especially in the UK and Germany. Let’s look at those two nations which showed poor growth in private credit as a percentage of GDP over time in the above analysis. Their economies now appear to be showing signs of serious damage and lack of resilience in the United Kingdom and Germany.

THE UK ECONOMY IS MORIBUND. In response to the Covid event, the UK economy collapsed and contracted dramatically. In the second quarter of 2020, the Annual GDP Growth contracted by 22%. This was a remarkable drop in economic activity. Since then, the GDP rebounded dramatically in early 2021 but then it fel and has not really recovered. UK GDP Growth has barely escaped a recession. Such an outcome is to be expected in an economy where private credit growth has been poor for such a long time.

Germanys poor leadership is abundantly evident. They have cut themselves off from a reliable, cheap supply of energy from Russia and have fallen in love with the “imminent threat” of Climate Change “emergency”. Their government is now in a state of collapse and seeking to ban its major opposition Party, the AfD. This is a further sign of decay.

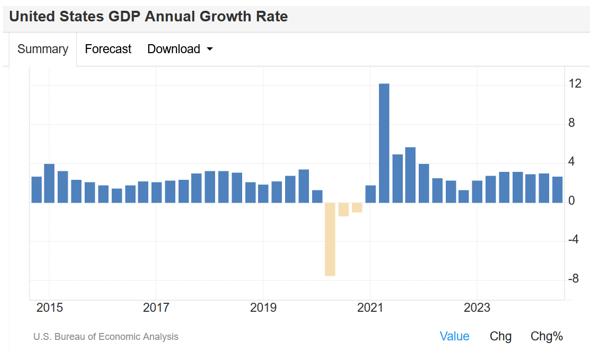

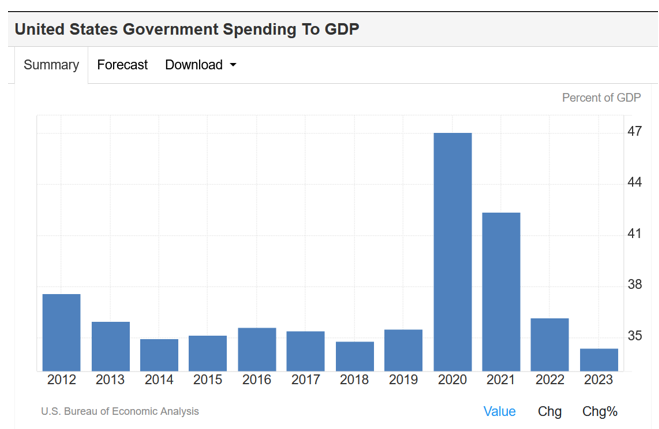

The US is another matter. It has suffered poor leadership over the last four years under Biden and the Democrats. Trump and the Republicans now have control. However, the future for the US economy is uncertain. When Trump was last in power US Government spending rose to record levels and kept the economy afloat. However, now circumstances are different.

If Trump (and Musk) follow through with their promises of dramatic reductions in deficit spending and huge increases in Tariffs on imported goods, then the US economy will be at risk of entering a period of economic stagnation and possible recession. Private Credit as a percentage of GDP is already above 200% which is a warning sign of potential future fragility.

Tesla has published financial statements at the end of the 3rd Quarter this year that showed it being Cash Flow Positive. Its Cash Balance had increased by $2.38 Billion in the prior 12 months. Tesla has 3.5 Billion shares outstanding at the balance date. If the company had then decided to pay that Cash increase out as a dividend to shareholders, then each share would have been paid less than $1. If that Dividend had been paid at the peak share price date over the last week of $360, then the Dividend Yield would have been $ 1/$360 = 0.28%

If the company, in a state of exuberant optimism, had instead decided to pay out the full Cash Balance ($18.97 Billion) as a dividend to shareholders, then each share would have been paid less than $6. And the Dividend Yield would have amounted to $6/$360 = 1.6%

If we allow the madness of a $25 Trillion valuation, that Dividend Yield would be 25 times lower at $6/$9,000 = 0.066%. Some Numerology inclined readers would wonder about the recurring 6 result (!) 666666666.

As BOOM pointed out last week, speculative madness can also be seen in the Argentina’s major stock market index, the Merval. It has risen from 200,000 to 2,000,000 over the last 20 months. That is known as a Ten Bagger. The Venezuelan Stock Index (the IBVC) has risen from 20,000 at the start of 2023 to 104,000 now. That is a Five Bagger.

Bitcoin has seen similar madness. Its latest surge has seen the price move from US$67,033 to $ 93,409. But that is a surge of just 40%. Not very impressive compared to the stock markets of Argentina and Venezuela over the last two years or the stock price moves of Tesla over the last two weeks.

GOLD AND SILVER DISAPPOINT. However, the speculative madness appears to have ceased in Gold and Silver. Over the last two weeks, triggered by Trump’s election win, Gold has plunged from around US$2,800 to $2,541 (more than 9%) and Silver has gone from US $35 to below $30 (more than 14%). The Gold and Silver bugs will be wondering what went wrong.

MORE ON THE UNITED (UNTIL THEY ARE NOT) NATIONS PACT FOR THE FUTURE. A month ago, BOOM analysed the bulk of the United Nations “Pact for the Future” document in the editorial dated October 6. However, there were two Annexures at the end of the document and BOOM stated that those will be dealt with on a later date. This is that later date. Here are the two Annexures. By providing this summary, BOOM has spared you the tedium of reading the entire, huge document.

- Annex 1 — Global Digital Compact

- Annex 2 — Annex II Declaration on Future Generations

Before starting the analysis, please note the following: If BOOM was a loyal employee of the UN, tasked with drafting these documents, he could simply issue a few requests to any AI product on the subject matter headings and then go to a long lunch (at an expensive restaurant in New York, Brussels, London or Berlin). THAT is all that would be needed to draft these documents. They are HOGWASH. There is no other way to describe them.

First, the GLOBAL DIGITAL COMPACT, or, perhaps it should be titled HOW TO BUILD A MONSTER? The document is chock full of Motherhood Statements, Virtue Signalling, Wish Fulfilment, Magical Thinking, Big Brother, Utopia on Earth, Centralised Global Governance (unelected, of course), and references to more and more Meetings, Committees, Reports and Reviews. Oh, and requests for lots more money to fund it all.

As you read BOOM’s comments, you will see all of this in crystal clear explanations.

[The UN document text is in bold and italicised. BOOM’s comments follow each paragraph and are presented in non-bolded, normal text.] To begin, of course, a goal must be boldly stated; to go where no man/woman or other gender has gone before .….

“Our goal is an inclusive, open, sustainable, fair, safe and secure digital future for all.” “We have strong foundations on which to build. Our digital cooperation rests on international law, including the Charter of the United Nations, international human rights law and the 2030 Agenda for Sustainable Development. Our cooperation must be agile and adaptable to the rapidly changing digital landscape.”

“To achieve our goal, we will pursue the following objectives: 1. Close all digital divides and accelerate progress across the Sustainable Development Goals; 2. Expand inclusion in and benefits from the digital economy for all; 3. Foster an inclusive, open, safe and secure digital space that respects, protects and promote human rights; 4. Advance responsible, equitable and interoperable data governance approaches; 5. Enhance international governance of artificial intelligence for the benefit of humanity.” BOOM’s Comment: Feeling tired yet? Distracted? Burdened by expectations? Or keen to see where this is going?

“This Compact is anchored in international law, including international human rights law. All human rights, including civil, political, economic, social and cultural rights, and fundamental freedoms, must be respected, protected and promoted and offline.” “Safe, secure and trustworthy emerging technologies, including artificial intelligence, offer new opportunities to turbocharge development. Our cooperation will advance a responsible, accountable, transparent and human-centric approach to the life cycle of digital and emerging technologies, which includes the pre-design, design, development, evaluation, testing, deployment, use, sale, procurement, operation and decommissioning stages, with effective human oversight;” “Our cooperation will be multi-stakeholder and harness the contributions of all” “We will enhance partnerships ……… including the mobilization of financial resources, capacity-building and the transfer of technology on mutually agreed terms …” BOOM’s Comment: Do you feel that the word “overkill” applies? Have you wondered yet who dreamt all this up? Were they paid to do so? And, if so, by whom All of this happened in just one paragraph:

- We acknowledge …. (this)

- We commit to …. (that)

- We recognise …. (this)

- We affirm …. (that)

- We recognise …. (this)

BOOM’s Comment: You get the drift (?)

“We commit, by 2030 ……. to connect the remaining 2.6 billion people to the Internet and to improve the quality and affordability of connectivity. We will aim for entry-level broadband subscription costs that are accessible to the widest section of the population …” BOOM’s Comment: All of that completed in just six short years. And “affordable” to 2.6 BILLION people spread all over the Planet (somehow) connected to the Internet because the UN said so …. in a document (?) Gee whiz. It sounds so simple.

“Invest in and deploy resilient digital infrastructure, including satellites and local network initiatives, that provide safe and secure network coverage to all areas, including rural, remote and “hard-to-reach” areas, and promote equitable access to satellite orbits, taking into account the needs of developing countries. We will aim for universal access at affordable rates and at sufficient speeds as well as reliability to enable meaningful use of the Internet ..” BOOM’s Comment: BOOM wonders – “invest in” implies that the UN will (somehow) discover a secret money machine to make all these investments and also a marvellous engineering capacity to build all the infrastructure in just six short years.

“Map and connect all schools and hospitals to the Internet ….” BOOM’s Comment: Of course …. why not?

“Promote sustainability across the life cycle of digital technologies ….” BOOM’s Comment: Let’s not forget that magic word “sustainability”

“Mainstream a gender perspective in digital connectivity strategies ….” BOOM’s Comment: Yes – all 54 genders will need to be considered. Or is it 72? Here is an article describing and defining 72 genders. The 72nd one is interesting: “Omnigender: Having or experiencing all genders.” https://www.medicinenet.com/what_are_the_72_other_genders/article.htm

“We commit by, 2030, to: (a) Develop, disseminate and maintain, through multi-stakeholder cooperation, safe and secure open-source software, open data, open artificial intelligence models and open standards that benefit society as a whole ….” BOOM’s Comment: They “commit” to it but how the hell can that be achieved?

“Develop and decide on a set of safeguards for inclusive, responsible, safe, secure and user-centred digital public infrastructure ….” BOOM’s Comment: Yes … gotta be safe …

“Increase investment and funding towards the development of digital public goods and digital public infrastructure ….” BOOM’s Comment: More “investment” from the Magical Money Tree? And let’s not forget “Human Rights” ….

“We commit to respect, protect and promote human rights in the digital space. We will uphold international human rights law throughout the life cycle of digital and emerging technologies so that users can safely benefit from digital technologies and are protected from violations, abuses and all forms of discrimination. ….” We commit by, 2030 to: (a) Create a safe and secure online space for all users that ensures their mental health and well-being …. BOOM’s Comment: Of course, safety is not enough. The UN must “ensure mental health and well-being” (somehow) to eight Billion people.

“We will work together to promote information integrity, tolerance and respect in the digital space, as well as to protect the integrity of democratic processes. We will strengthen international cooperation to address the challenge of misinformation and disinformation and hate speech online and mitigate the risks of information manipulation in a manner consistent with international law ….” BOOM’s Comment: The UN will become the only arbiter of what is ‘The Truth’ and will ban all misinformation and disinformation. Committees will be required and meetings, of course. Many of them. And don’t forget that all this will cost MONEY. Lots of money.

“We commit, by 2030 to: (a) Design and roll out digital media and information literacy curricula to ensure that all users have the skills and knowledge to safely and critically interact with content and with information providers and to enhance resilience against the harmful impacts of misinformation and disinformation ….” BOOM’s Comment: The UN will educate the WORLD – by 2030 …… all eight Billion of them, in The Truth, of course. No misinformation or disinformation will (ever) emanate from UN headquarters.

“Provide, promote and facilitate access to and dissemination of independent, fact-based, timely, targeted, clear, accessible, multilingual and science based information to counter misinformation and disinformation ….” “Promote access to relevant, reliable and accurate information in crisis situations, to protect and empower those in vulnerable situations ….” BOOM’s Comment: We must remember the “vulnerable”, of course.

“We commit, by 2030, to: (a) Increase financing for data and statistics from all sources and enhance efforts to build capacity in data and related skills, as well as responsible data use, particularly in developing countries. We will scale up predictable financing for sustainable development data ….” BOOM’s Comment: WE NEED MONEY. LOTS OF IT. WE WANT MONEY, MONEY MONEY.

“We commit, by 2030, to advance consultations among all relevant stakeholders to better understand commonalities, complementarities, convergence and divergence between regulatory approaches on how to facilitate cross-border data flows with trust so as to develop publicly available knowledge and best practices ….We will continue discussions in the United Nations ….” BOOM’s Comment: They are gonna talk to EVERYBODY … but only if they are “relevant” …. of course.

“We recognize the need for a balanced, inclusive and risk-based approach to the governance of artificial intelligence (AI), with the full and equal representation of all countries ..” BOOM’s Comment: They are good at “recognising needs”. And there are lots of them.

“We therefore commit to: (a) Establish, within the United Nations, a multidisciplinary Independent International Scientific Panel on AI with balanced geographic representation to promote scientific understanding through evidence-based impact, risk and opportunity assessments, ….” BOOM’s Comment: And that will need LOTS of meetings, committees, reports, reviews and MONEY. BOOM is feeling the need for a “high level meeting” proposal, a report and the formation of yet another committee.

“We decide to convene a high-level meeting entitled “High-level review of the Global Digital Compact”, to take place during the eighty-second session of the General Assembly, based on a progress report by the Secretary-General and with the input and meaningful participation of all stakeholders, including the Commission on Science and Technology for Development, the Internet Governance Forum and World Summit on the Information Society action line facilitators. We request the President of the General Assembly to appoint co-facilitators, ….” BOOM’s Comment: By providing this summary, BOOM has spared you the tedium of reading the entire document. But there is one notable matter involving the Internet that is never mentioned in the document.There is NOT A SINGLE MENTION OF THE INTELLIGENCE AND SURVEILLANCE OPERATIONS that scour the Internet 24 hours a day, 365 days a year, spying on the citizens of all nations.

Annex II Declaration on Future Generations or perhaps it should have been titled: DRAWING UP A LIST OF ASPIRATIONS

“Cognizant that future generations are all those generations that do not yet exist, and who will inherit this planet ….” BOOM’s Comment: BOOM is so glad to see that the UN can define “future generations” .. so reassuring …

“Further committing to build a stronger, more effective and resilient multilateral system based on international law, with the United Nations at its core, underpinned by transparency, confidence and trust, for the benefit of present and future generations ….” BOOM’s Comment: With the (unelected) officials of the United Nations at its very core, of course.

Four legs good … Two legs better “….. we hereby pledge to: Promote international stability, peace and security ….” Ensure peaceful, inclusive and just societies ….” BOOM’s Comment: Doesn’t that go without saying? No, of course not. We must make ourselves clear to the humble citizens of the Earth.

“Implement policies and programmes to achieve gender equality ….” BOOM’s Comment: Equality between all 72 genders? BOOM cannot see how this can be brought about.

“Eliminate all forms of persistent historical and structural inequalities ….” BOOM’s Comment: Mustn’t forget to mention all the other inequalities that exist, must they?

“Honour, promote and preserve cultural diversity and cultural heritage ….” BOOM’s Comment: BOOM cannot understand how “diversity” can be “equalised”.

“Recognize, respect, promote and protect the rights of Indigenous Peoples ….”

BOOM’s Comment: Oh yes, must not forget to mention the poor indigenous peoples …

“Undertake comprehensive and targeted strategies to achieve inclusive economic growth and sustainable development, food security and the eradication of poverty in all its forms and dimensions, including extreme poverty ….” BOOM’s Comment: And some food might be useful for the poor …. (?)

“Prioritize urgent action to address critical environmental challenges ….” BOOM’s Comment: Almost forgot to (urgently) mention the environment (!!)

“Harness the benefits of existing, new and emerging technologies and mitigate the associated risks through effective, inclusive and equitable governance at all levels ….” BOOM’s Comment: Our committees, reports and recommendations will “harness technologies”, of course.

“Strengthen cooperation among States in their response to demographic trends and realities ….” “Strengthen cooperation among States to ensure safe, orderly and regular migration between countries ….” BOOM’s Comment: We, with our committees, will ensure that migration is regular, safe and orderly. MMmmm …..

“Invest in accessible, safe, inclusive and equitable quality education for all ….”

“Protect the right to the enjoyment of the highest attainable standard of physical and mental health ….” BOOM’s Comment: The UN will become the Big Educator and the Big Protector. Huh? Big Brother? Big Sister? Or Big 72 Gendered?

“Take note of the Secretary-General’s proposal to appoint a Special Envoy for Future Generations to support the implementation of this Declaration; (b) Decide to convene an inclusive high-level plenary meeting of the General Assembly on future generations that will review the implementation of this Declaration during the eighty-third session of the General Assembly and provide updates on the actions taken to safeguard the needs and interests of future generations; (c) Request the Secretary-General to present a report on the implementation of this Declaration for consideration at the high-level plenary meeting to be held during the eighty-third session of the General Assembly. ….”

COMING NEXT:

- The Financial Jigsaw Part 2 Chapter 7 – GLOBAL GOVERNMENT – Saturday, November 23, 2024

- BOOM Global Financial Review, Tuesday November 26, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models. Prof Richard Werner explains how things are going now with CBDCs:

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.