Futures Slide, Oil, Gold And Dollar Spike But No Panic Moves

As expected, futures opened for trading amid a risk off tone, with oil, gold, the dollar and other safe havens ripping, but there is hardly any sense of panic, as investors remain calm with Iran so far showing no signs of retaliation to this weekend’s US attacks.

While emini S&P futures opened about 60 points, or 1% lower, at 6pm ET, they have since trimmed the loss in half, and at last check were back to just shy of 6,000, and about 2% below all time highs.

A similar kneejerk reaction was observed in oil which surged in early Monday trading, with some trading models indicated WTI contracts would open around $79/bbl – which it did – but then quickly retraced gains by half, rising $3 to $76…

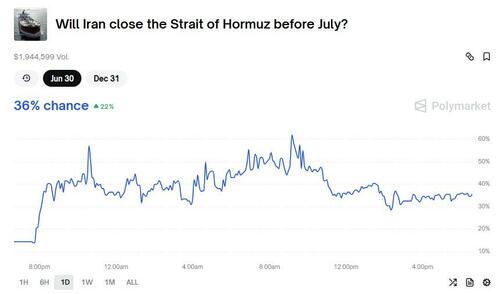

… which is also well below the implied price assuming the Polymarket odds of a straits of Hormuz closure are accurate at 35% (assuming a fair value for oil of $60, and a worst case scenario of $120 at full closure), oil should be trading around $80.

Brent’s prompt spread, the closely-watched difference between its two nearest contracts, widened to as much as $1.99 a barrel in backwardation, from $1.53 on Friday. That’s a bullish pattern indicating concern about tight prompt supplies.

Turning to FX, the Swiss franc is the only major currency which is holding its own against the US dollar in early action, with the yen – which supposedly was on its way to becoming a new “flight to safety” in the (don’t laugh) world where the US was no longer exceptional, tumbling and reminding everyone that Japan with its mingblowing 400% in consolidated debt/GDP is the biggest basket case of all, and the yen will be trading at 1000 first before it goes back to 100 (and that’s only after the BOJ pulls a Maduro and chops off a number of zeros from the currency).

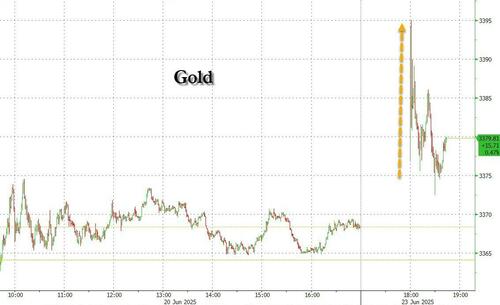

As for fiat alternatives, we once again are seeing mirror reactions, with gold spiking and ramping onward to all time highs…

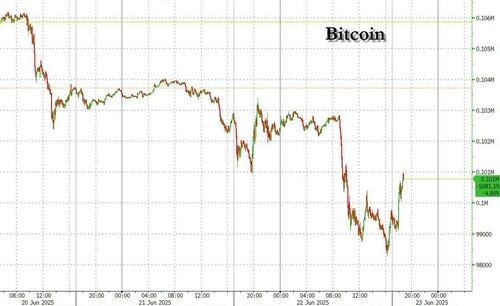

… while the high beta “digital gold” – which as always was the only asset class open during the weekend’s peak stress moments when panicans dumped it in droves as they always do – slumped as it always does when there is geopolitical turmoil, confirming yet again that bitcoin and the crypto space in general has a long way to go before it becomes a true safe asset.

“The market will closely watch Iran’s response — particularly whether it will move to disrupt Middle Eastern oil flows, directly or indirectly through its regional proxies,” said Muyu Xu, a senior crude analyst at Kpler Ltd. “If Iran blocks the Strait of Hormuz, even for one day, oil can temporarily hit $120 or even $150.”

Iran’s parliament has called for the closure of the strait, according to state-run TV. Such a move, however, could not proceed without the explicit approval of Supreme Leader Ayatollah Ali Khamenei.

Besides the straits, Tehran could opt to target crude infrastructure in rival suppliers in the Middle East, such as fellow OPEC+ producers Saudi Arabia, Iraq or the United Arab Emirates. Both Riyadh and Baghdad expressed concern following the US attack. Iran could also orchestrate attacks on ships on the other side of the Arabian peninsula in the Red Sea, encouraging Yemen-based Houthi rebels to harass vessels. After the US attacks, the group threatened retaliation.

If the hostilities escalate, Tehran’s own oil-producing capabilities could be targeted, including the key export hub at Kharg Island. Such a move, however, could send crude prices soaring, an outcome that Washington might want to avoid. So far, Kharg Island has been spared, with satellite imagery pointing to a drive by Iran to expedite its exports of oil, and Polymarket showing negligible odds of an attack.

Some good news: odds that Kharg island oil terminals will be hit have not budged, and are substantially lower vs a month ago pic.twitter.com/uOMQrSQ58a

— zerohedge (@zerohedge) June 22, 2025

Among the wider market fallout, Bloomberg notes that fuels also strengthened on Monday with Diesel futures gained as much as 7.8% to hit the highest price since July 2024, outpacing the move in crude.

Tyler Durden

Sun, 06/22/2025 – 18:55