Cocoa Biggest Commodity Winner Of Year As Food Inflation “Enters Dangerous Territory”

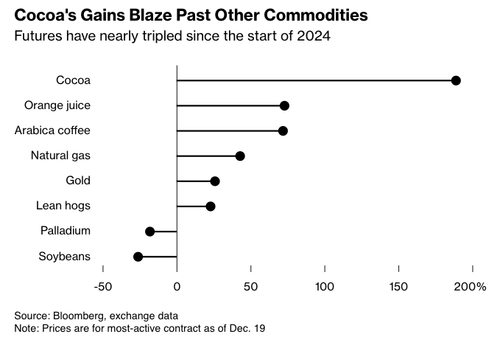

One theme we’ve harped on this year has been the reignition of global food prices, which show little sign of abating as the new year quickly approaches. Among the most impressive rallies has been in the cocoa market, outpacing all major commodities in 2024 amid tightening global supplies. Prices for orange juice and coffee have also surged, highlighting sticky food price inflation.

The dire situation in West Africa — home to the world’s largest cocoa farms — has pressured bean prices to record highs as crop disease and adverse weather conditions sparked a global supply crunch.

Last week, Goldman analysts told clients to go long cocoa (more about the trade here) for “another rally” driven by “structural supply deficits, under-hedged consumers, and historically low warehouse stocks.”

Supply concerns pushed cocoa futures in New York to nearly $13,000 per ton last week. This surge has driven prices by almost 200% this year, making cocoa a top commodity performer.

Next is orange juice; futures in New York soared 73% on the year amid imploding citrus production in Florida.

After OJ, Arabic coffee futures in New York are up 72% this year, driven by ongoing fears of a global supply crunch. Prices have hit a record high.

Broad food price trends via the Food and Agriculture Organization of the United Nations’ Food Price Index, which tracks international prices of a basket of globally traded foods, show that prices have alarmingly re-accelerated this year.

We warned the other week that food price inflation has “entered very dangerous territory and expect the trends that have been pushing up food prices to accelerate even more in 2025.”

Separately, we penned two notes in the last week on retail egg prices zooming to new highs and beef prices in record territory.

Tyler Durden

Sat, 12/21/2024 – 12:15