American Retail Giants Demand Chinese Suppliers Cover Up To 66% Of US Import Tariffs

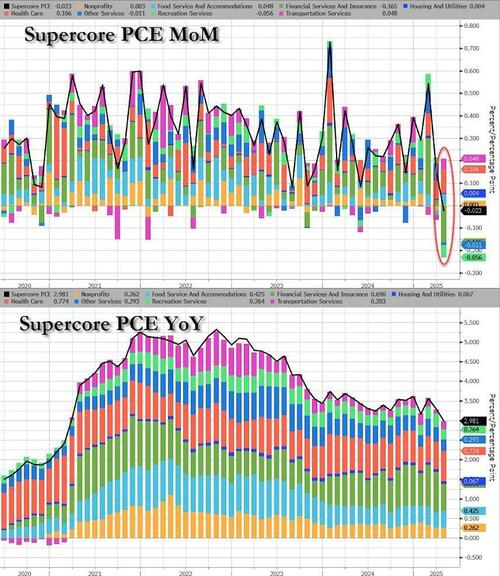

Last week we showed that contrary to conventional wisdom, inflation – so widely and erroneously expected to soar after Trump’s tariffs – had not only continued to decline, but the Fed’s most closely watched metric, supercore PCE, just posted its biggest monthly drop since the covid crash.

And it’s about to get even worse for the inflation fanatics: according to the South China Morning Post, American retail giants are now demanding that their Chinese suppliers shoulder half to 66% of the cost of US import duties, as the ongoing US-China trade war ramps up pressure on businesses’ bottom lines.

Amid widespread confusion over who will shoulder the burden of import tariffs, US retailers have been quietly locked in talks with Chinese producers for weeks over how to handle the additional costs caused by the trade war, with the firms facing intense political pressure at home to “eat the tariffs” and keep prices stable.

While Walmart and several other major US retail groups previously agreed to bear the full cost of the tariffs when they asked their Chinese suppliers to resume shipments in late April, global brands including several US retail giants are now pushing suppliers in both China and parts of Southeast Asia to absorb a large chunk of the cost of the levies, according to sources from suppliers serving companies including Walmart, Target, Nike, Puma and Adidas.

“Most of our customers, the garment vendors exporting to major retailers and brands, are being asked to cover 50 to 66 per cent of the current tariffs,” said an executive at a fashion supplier, which produces and sources from China and Southeast Asia and then sells across the United States and Europe.

While negotiations remain fluid, the details of how the tariff costs will be divided have not yet been finalized, the SCMP sources stressed, as both sides remain in constant contact as they try to navigate a “tough time” for the industry.

But many Chinese suppliers said they would struggle to bear the additional costs being demanded of them – especially if the current 90-day truce in the US-China trade war expires without Beijing and Washington reaching a deal.

In mid-May, Beijing and Washington agreed to drastically scale back tariffs on each other’s products for 90 days, with the US reducing its additional duties on Chinese goods from 145 per cent to 30 per cent and China slashing its levies on US products from 125% to 10%. But absent a deal, the tariffs will skyrocket back to three-digit levels in August. Last week, Treasury Secretary Scott Bessent admitted on Thursday that talks between Beijing and Washington were currently “a bit stalled”.

A source with a stationery maker in eastern China’s Zhejiang province told the Post that the company had been in discussions with Walmart and other US retailers over “a backup plan” for what may happen after the tariff truce ends in August.

Walmart agreed to cover the full cost of any tariffs until August in its previous deals with the stationery maker, but the US retailer has yet to place any orders beyond August.

According to the source, the Zhejiang manufacturer is capable of footing about 30 per cent of the additional costs from the tariffs, but there is “no room” to go up to 50 per cent or higher. The company has yet to reach an agreement with Walmart.

“We agree to get prepared for the worst situation, while hoping for the best,” the person said, referring to a potential return to triple-digit tariffs.

When contacted by the Post for comment, a spokesperson for Walmart said: “We have always worked to keep our prices as low as possible. We’ll keep prices as low as we can for as long as we can given the reality of small retail margins.”

Puma declined to comment, while Target, Nike and Adidas did not immediately respond to the Post’s inquiry.

Bessent said on Thursday that there was “likely” a need for US President Donald Trump and President Xi Jinping to intervene to get a deal over the finishing line before August 12.

In keeping with Beijing’s protecionist tradition, there has been a focus in China on mitigating the impact of the trade war by helping exporters pivot to the domestic market. But that often is not possible for Chinese factories that make products on a contract basis for foreign brands, according to a report by Christopher Beddor, deputy China researcher at analysis firm Gavekal.

“One executive at a large online retailer notes that pants made for the US market run much longer than those in China,” he wrote. “There’s also less domestic demand for oven gloves – as fewer housing units in China have ovens – and no buyers for some products such as bulk Christmas cards.”

Chinese exporters “will almost certainly be forced to curtail output and divert supply to other markets”, Beddor noted, hinting at a wave of deflationary exports by China.

In the US, meanwhile, retailers are coming under political pressure not to raise prices. Walmart CEO Doug McMillon warned on May 15 that the retail giant was unable to absorb all the costs of the trade war and would need to hike some prices. Two days later, Trump posted on social media that Walmart and China should “eat the tariffs”.

On May 21, Nike announced that it would start raising prices to offset the high costs brought by US tariffs. German sportswear brand Puma, meanwhile, has adapted its supply chain by cutting the volume of goods being shipped directly from China to the US, but has not ruled out the possibility of price rises.

Fellow German sportswear giant Adidas said in a company statement on April 29 that it “cannot make any ‘final’ decisions” on what to do, but added that “cost increases due to higher tariffs will eventually cause price increases”.

Target CEO Brian Cornell said on May 21 that price hikes were a “very last resort” for the company as it sought to deal with the cost of higher tariffs.

On Sunday, Trump said his tariff policies were aimed at promoting the reshoring of hi-tech products, rather than clothing and footwear, to America. “We’re not looking to make sneakers and T-shirts,” he said. “We can do that very well in other locations. We are looking to do chips and computers and lots of other things, and tanks and ships.”

Tyler Durden

Mon, 06/02/2025 – 14:05