Which Countries Buy The Most US Coal?

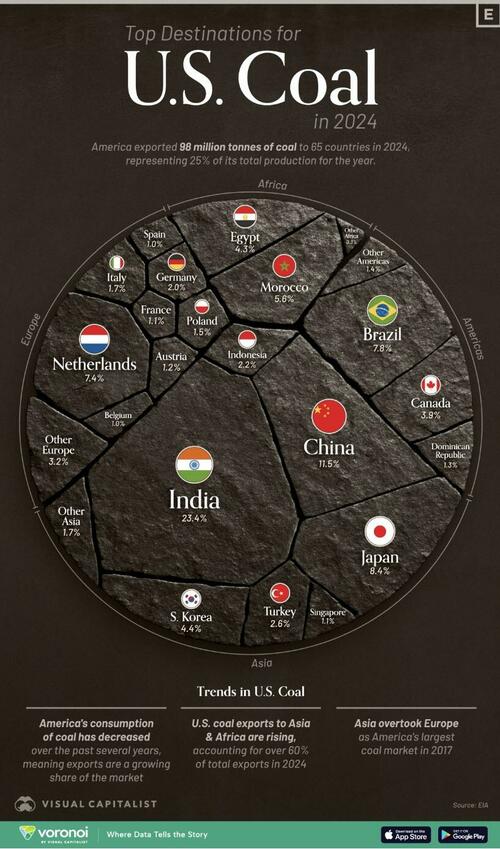

Coal remains a major U.S. export, even as the domestic energy mix shifts toward natural gas and renewables. In 2024, America exported nearly 100 million tonnes of coal to countries around the world, with a concentration of buyers in Asia.

This visualization, via Visual Capitalist’s Marcus Lu, breaks down the top destinations for U.S. coal exports last year. The data for this graphic comes from the U.S. Energy Information Administration (EIA). It shows 2024 coal export volumes by destination, measured in millions of tonnes.

Asia: The Rising Demand Hub

India led the pack with 23.4% of all U.S. coal exports, followed by China (11.5%) and Japan (8.4%). Combined, these three Asian countries accounted for nearly 43% of all American coal exports.

| Rank | Destination | 2024 (million tonnes) | % of Total |

|---|---|---|---|

| 1 | 🇮🇳 India | 22.9 | 23.4 |

| 2 | 🇨🇳 China | 11.3 | 11.5 |

| 3 | 🇯🇵 Japan | 8.2 | 8.4 |

| 4 | 🇧🇷 Brazil | 7.6 | 7.8 |

| 5 | 🇳🇱 Netherlands | 7.2 | 7.4 |

| 6 | 🇲🇦 Morocco | 5.4 | 5.6 |

| 7 | 🇰🇷 South Korea | 4.3 | 4.4 |

| 8 | 🇪🇬 Egypt | 4.2 | 4.3 |

| 9 | 🇨🇦 Canada | 3.8 | 3.9 |

| 10 | 🇹🇷 Turkey | 2.5 | 2.6 |

| 11 | 🇮🇩 Indonesia | 2.1 | 2.2 |

| 12 | 🇩🇪 Germany | 1.9 | 2.0 |

| 13 | 🇮🇹 Italy | 1.7 | 1.7 |

| 14 | 🇵🇱 Poland | 1.5 | 1.5 |

| 15 | 🇩🇴 Dominican Republic | 1.3 | 1.3 |

| 16 | 🇦🇹 Austria | 1.1 | 1.2 |

| 17 | 🇫🇷 France | 1.1 | 1.1 |

| 18 | 🇸🇬 Singapore | 1.0 | 1.1 |

| 19 | 🇪🇸 Spain | 1.0 | 1.0 |

| 20 | 🇧🇪 Belgium | 0.9 | 1.0 |

| 21 | 🇭🇷 Croatia | 0.9 | 0.9 |

| 22 | 🇦🇷 Argentina | 0.7 | 0.8 |

| 23 | 🇵🇰 Pakistan | 0.7 | 0.7 |

| 24 | 🇫🇮 Finland | 0.6 | 0.7 |

| 25 | 🇸🇪 Sweden | 0.6 | 0.6 |

| 26 | 🇺🇦 Ukraine | 0.5 | 0.5 |

| 27 | 🇲🇾 Malaysia | 0.5 | 0.5 |

| 28 | 🇨🇱 Chile | 0.3 | 0.3 |

| 29 | 🇿🇦 South Africa | 0.2 | 0.2 |

| 30 | 🇹🇭 Thailand | 0.2 | 0.2 |

| 31 | 🇦🇪 UAE | 0.2 | 0.2 |

| 32 | 🇬🇧 UK | 0.2 | 0.2 |

| 33 | 🇬🇹 Guatemala | 0.1 | 0.2 |

| 34 | 🇻🇳 Vietnam | 0.1 | 0.1 |

| 35 | 🇷🇴 Romania | 0.1 | 0.1 |

| 36 | 🇹🇬 Togo | 0.1 | 0.1 |

| 37 | 🇳🇴 Norway | 0.1 | 0.1 |

| 38 | 🇭🇳 Honduras | 0.1 | 0.1 |

| 39 | 🇨🇭 Switzerland | 0.1 | 0.1 |

Since 2017, Asia has eclipsed Europe as the leading destination for U.S. coal.

In 2024, India alone purchased 22.9 million tonnes. India’s high demand for U.S. coal is driven by a combination of energy security needs, domestic production gaps, and infrastructure limitations. Currently, the country relies heavily on coal to generate electricity—over 70% of its electricity comes from coal-fired power plants.

Europe’s Waning Role

While several European countries still import American coal, their overall share has declined. The Netherlands remains a key buyer (7.4%), but other nations like Germany, Italy, and Poland account for smaller volumes. The EU’s push to phase out coal and meet climate targets has sharply reduced demand in the region.

Notably, many European buyers now import U.S. coal primarily for metallurgical (steelmaking) rather than power generation uses.

Emerging and Niche Markets

Beyond Asia and Europe, a number of countries in Latin America, Africa, and the Middle East imported smaller quantities of U.S. coal in 2024. Brazil (7.8%) and Morocco (5.6%) were notable non-Asian buyers.

If you enjoyed today’s post, check out What Powered the World in 2024? on Voronoi, the new app from Visual Capitalist.

Tyler Durden

Mon, 09/22/2025 – 05:45