It’s The Denominator, Stupid!

Authored by Mark Jeftovic via BombThrower.com,

Wrapping your head around Bitcoin’s inexorable rise.

In every issue of The Bitcoin Capitalist there is a section called “This Month’s FUD”, where I look at the “Death of Bitcoin” narratives that emerged over the last few weeks and mercilessly debunked them. It’s not hard, because most, if not all Bitcoin FUD vectors are belaboured retreads of three or four themes – all of which have already been litigated. It’s rare to see anything new.

We all like to think we’re the first to identify a particular flaw, risk, or threat to #Bitcoin .

In reality, someone meticulously dissected the viewpoint in a bitcointalk post 10+ years ago. pic.twitter.com/oXY2CIdO2b

— Anil ⚡ (@anilsaidso) May 15, 2023

After the 2022 crypto-winter, Bitcoin has been rising steadily for two years. But for a few months recently, the “FUD” vectors had died down to a whimper. If it wasn’t for Peter Schiff and his incessant twitter meltdowns over Bitcoin, there would have been no FUD at all for awhile.

Then, November 5th hits.

Even though Trump had endorsed Bitcoin earlier in the year – giving a landmark keynote at Bitcoin2024 in Nashville, the FUD was relatively lacklustre and muted until the election put Bitcoin straight into the middle of the new zeitgeist.

Many have likened the stunning election upset (in the sense that it was such an incontrovertible blowout), to a “shift in timelines”, as if our entire reality quantum-jumped into a parallel universe.

Now the former incumbents are scrambling and in full blown panic. The old zeitgeist and it’s total domination by the far-left neo-Marxists is crumbling in real time. And while Bitcoin is decidedly apolitical beyond the antiquated “left-vs-right” paradigm, the fact is that Bitcoin continues to win, and Trump backed Bitcoin.

(The real battle, as I have long said, is between the forces of centralization – control freaks, basically – and decentralization but because leftism and socialism requires authoritarianism, if not full blown dictatorships, the Venn diagrams for leftism / centralization largely overlap).

So now the FUD-o-meter is on 11, all the time: Trump winning again, $100K Bitcoin and Microstrategy eating the stock market is triggering for many – it’s just all so crazy.

(And while quantum computing may sound like a novel, new Bitcoin killer, it isn’t, and I recently wrote why quantum computing can’t kill Bitcoin)

Why would this magic internet money become the basis of national strategic reserves? And why should Microstrategy be able to simply issue debt to buy up more of this stuff and be rewarded by the markets for doing so?

Because, it’s the denominator, stupid.

If you can’t wrap your brain around Bitcoin, it’s because you’re probably hardwired to look at finance and economic through the lens of everything is an asset (numerator) measured in some “fixed” currency, like a USD – the denominator.

REAL ESTATE

———–

$$$$$$$$$$$

or maybe

MSFT / GOOG / NVDA / META

————————–

$$$$$$$$$$$$$$$$$$$$$$$$$$

or anything else you want over the $$$$$$$. But your problem, is you think it’s also

Bitcoin

——-

$$$$$$$

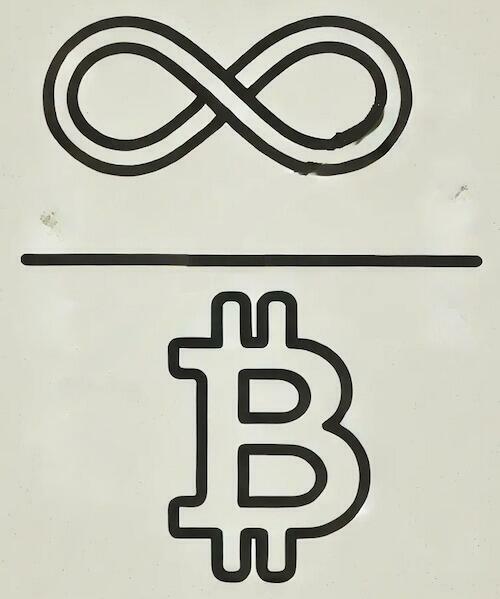

That denominator? Those $$$$$$$$$$$$$$$$?

That’s supposed to be fixed. In order to provide a semblance of rationality to the numerator / denominator equation, at least when it comes to measuring value – the denominator isn’t supposed to be moving or if it is, it has to at least be constrained by some kind of economic trade-off. In the old-timey days, on a gold standard, there was a 2% natural inflation rate that was mostly limited by the ability to discover new gold deposits and actually mine the stuff.

It was a pretty good system and the world moved to it under its own incentives, not by the decree of a committee of experts.

By 1900, approximately fifty countries were on a gold standard. including all industrialized nations. The interesting fact is that the modern gold standard was not planned at an international conference, nor was it invented by some genius. It came by itself, naturally and based on experience. The United Kingdom went on a gold standard against the intention of its government. Only much later did laws turn an operative gold standard into an officially sanctioned gold standard.

– Ferdinand Lips, Gold Wars.

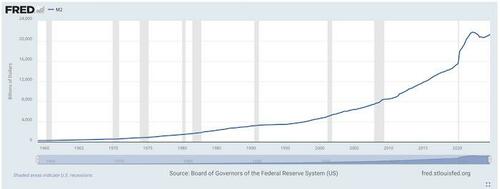

The last vestiges of the gold standard were dispensed with in 1971, with the Nixon Shock – and since then, the dollar standard, the denominator for the global monetary system, has been on a slow roll into hyperinflation:

Everybody has seen this chart. It makes your eyes glaze over. Nobody cares even though this is showing you the disintegration of the denominator we use to measure every economic transaction on earth.

Should be a big deal.

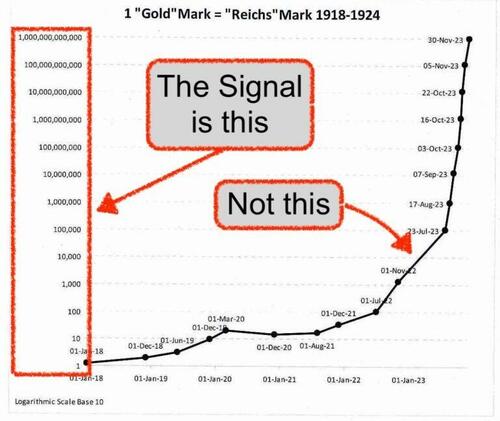

The only time it seems to matter, is during a hyperinflation, when you can see it clearly in the X-axis of a chart being viewed in logarithmic mode:

I’ll give you one guess which monetary challenger is flashing the signal today…

But people are looking at the linear chart, and calling Bitcoin a bubble because they still think that Bitcoin is the numerator in an equation denominated by fiat dollars (a.k.a “cuck bucks”).

I can guarantee you this: none of the billionaires who are allocating to Bitcoin think like that. Nobody building gigantic mining farms is thinking like that. Nor are the nation states and sovereign states who are about to launch strategic Bitcoin reserves. And Michael Saylor certainly isn’t thinking like that.

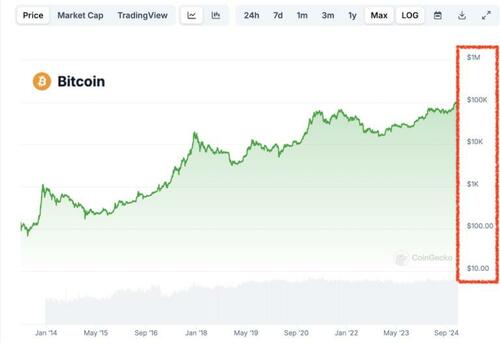

All you have to do is press the “log” button on the chart and it all becomes clear…

There is a secret cheat-code that will jailbreak your brain out of “Bitcoin is a bubble” mode and help you understand what is really happening.

One click can literally change your perspective.

People are trying to tell you that this is unsustainable 👇

Hence, this must be a… pic.twitter.com/jiaFWWvTHl

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) November 16, 2024

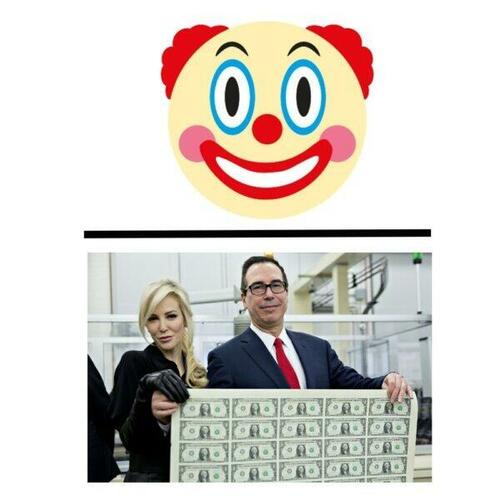

So while we’re all stuck (for the moment) in this clown car economy where the numerators are denominated by infinite quantities of fiat literally backed by nothing, and the solution to everything is to print more of it…

Anybody who truly understands Bitcoin (everybody with the laser eyes), looks at it like this:

…and is opting out of the clown ride by moving their wealth – as much as they can into THE NEW DENOMINATOR.

And the new denominator, is Bitcoin.

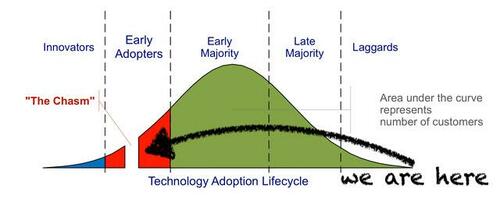

It’s still pretty early.

When you realize that the current monetary base is scaffolded together on about $80 trillion USD in M2 money supply (all currencies) and about $300 trillion in bonds (debt, denominated in a rapidly devaluing currency, which is backed by …nothing) and compare it to Bitcoin’s $2 trillion market cap, you realize how early we are in this story.

In technological adoption curves, Bitcoin is still somewhere around 1998 to 2002 internet, we haven’t even hit 10% penetration yet, which is that famed “tipping point” for when a new innovation (in this case, decentralized, digital non-state money) takes hold and goes into rapid proliferation.

While Bitcoin uptake is estimated to be somewhere around 4%-5% of the global population, my guess is with the events of 2024, we just have, or are in the process of “crossing the chasm” – another aspect of the technology adoption curve where it blows through the final wave of doubt, fear, skepticism and mal-investment before permanently breaking through to becoming the new paradigm.

This happens all the time – just not very often with the monetary base layer – but it does happen there too.

It’s happening now.

* * *

The Bitcoin Capitalist Letter, my premium newsletter that covers Bitcoin, crypto stocks and the digital asset space. You can catch a trial deal here »

Sign up for the Bombthrower mailing list and get a free copy of the Crypto Capitalist Manifesto here »

Tyler Durden

Sat, 12/21/2024 – 19:15