Solid 30Y Auction Stops Through, Easing Long-End Selloff Concerns

After two impressive coupon auctions ahead of yesterday's FOMC, moments ago we got the week's final auction, a sale of $22BN in 30Y paper. The auction was solid: it through, with a bounce in the bid to cover and solid buyside demand despite a modest dip in foreign bidders.

Here are the details.

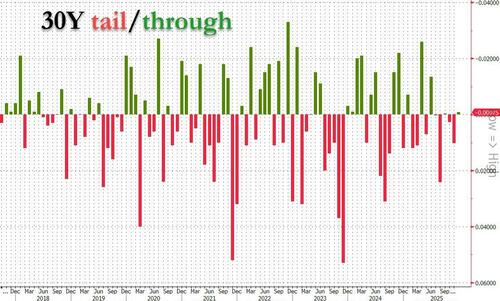

The auction stopped at a high yield of 4.773%, up from 4.694% in November, although unlike the November auction, today's auction stopped through the 4.774% When Issued by 0.1bps. This was the first through since September, and only the second in the past 6 months.

The bid to cover rose to 2.365% from 2.295% in November, and was just fractionally above the 2.355% six auction average.

The internals showed continued solid buyside demand: Indirects were awarded 65.4%, down from 71.0% in November. but stripping away that one outlier auction, the foreign demand was the highest since January. And with Directs taking 23.5%, in line with the recent average of 23.9%, Dealers were left with 11.2%, down from 14.5% last month and below the six auction average of 12.5%.

Overall, this was another solid auction with impressive demand and refuting creeping concerns about rapidly rising long-end yields amid a global bond selloff, one which for now at least has avoided the US.

Tyler Durden

Thu, 12/11/2025 - 13:30

The post <a href=https://www.zerohedge.com/markets/solid-30y-auction-stops-through-easing-long-end-selloff-concerns target=_blank >Solid 30Y Auction Stops Through, Easing Long-End Selloff Concerns</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...