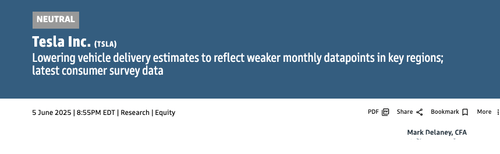

Goldman Slashes Tesla Delivery Estimates On Weak Monthly Trends

Goldman Sachs analysts cut Tesla's delivery forecasts, slashed earnings estimates, and scaled back expectations for brand momentum across key markets. The message is clear: demand is weakening, competition is accelerating, and consumer enthusiasm is fading. This sentiment is also shared with UBS.

"We're lowering our Tesla vehicle delivery assumptions and EPS estimates to better reflect weaker monthly datapoints in key regions (e.g. China, the US, and Europe), and also consumer survey data on Tesla (per HundredX and Morning Consult)," analysts Mark Delaney, Dan Duggan, and others wrote in a note to clients on Thursday.

The analysts revised their outlook and now expect 2Q25 deliveries to come in at just 365,000 units, a sharp downgrade from the prior 410,000 estimate—and well below Visible Alpha Consensus data of 417,000.

Industry and registration data through May show continued year-over-year declines across key global markets, including the US, China, and Europe.

Full-year delivery estimates were also slashed:

2025: cut from 1.70 million to 1.575 million

2026: cut from 1.95 million to 1.865 million

2027: cut from 2.20 million to 2.15 million

2025: $1.10 (was $1.25)

2026: $2.05 (was $2.15)

2027: $3.00 (was $3.10)

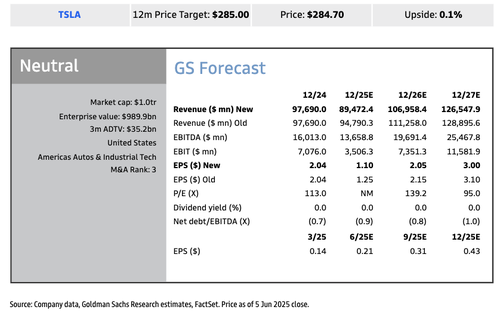

To gauge consumer sentiment, analysts cited data from HundredX and Morning Consult, which showed declines in Tesla's brand buzz and purchase intent across North America and Europe. Sentiment remains particularly weak in Canada, France, Germany, and the UK, while China stands out as the lone bright spot.

Goldman's outlook echoes UBS' take from last week, which warned that global enthusiasm for the Tesla brand is waning. Both firms maintained a cautious stance on the stock.

"Overall, we remain cautious on Tesla stock," UBS analyst Joseph Spak said in the note. UBS maintains a Sell rating with a 12-month price target of $190.

Meanwhile, Daniel Ives of Wedbush Securities recently raised his 12-month price target on Tesla to a Street-high $500 from $350, citing the near-term launch of Tesla's autonomous ride-hailing Cybercabs as a major catalyst to spark the "golden age of autonomy."

Tyler Durden

Fri, 06/06/2025 - 08:05

The post <a href=https://www.zerohedge.com/technology/goldman-slashes-tesla-delivery-estimates-weak-monthly-trends target=_blank >Goldman Slashes Tesla Delivery Estimates On Weak Monthly Trends</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...