Gold vs The Dollar: The Death Of Fiat In One Chart

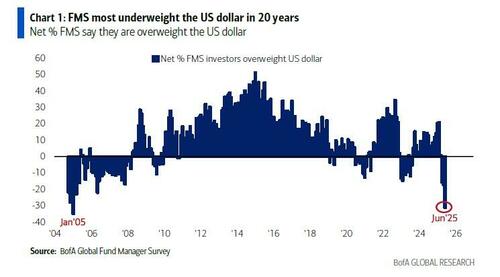

Earlier today we reported that the latest BofA Fund Manager Survey confirmed what most already knew: that the shoeshine boy, the kitchen sink, and the basement-dwelling daytrader, not to mention everyone on Wall Street, were short the dollar. In fact, according to the FMS respondents, professional traders were effectively shorting the dollar in record amounts.

But while we will leave aside the debate whether this record dollar short will transform into a record squeeze, another question is just as appropriate: is the decline and fall of the US dollar just a one-time flash in the pan, or is there something much more ominous here than meets the eye.

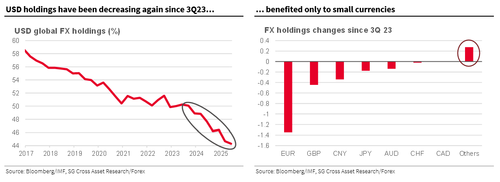

The answer, it turns out, is the latter: the decline of the dollar has been truly a secular development, one which started over a decade ago but was kicked into higher gear in the aftermath of the 2022 Ukraine war when the weaponization of the US Dollar sparked a flight away from the greenback - i.e., dedollarization - by any regime that was worried it may be on the receiving end of SWIFT sanctions.

But what is perhaps far more notable is that as Socgen shows, since 2024, dedollarization has not benefited any of the major reserve currencies as one would expect in a fiat world where one currency's loss is another currency's gain. Instead, the share of gold in the IMF's classification has increased.

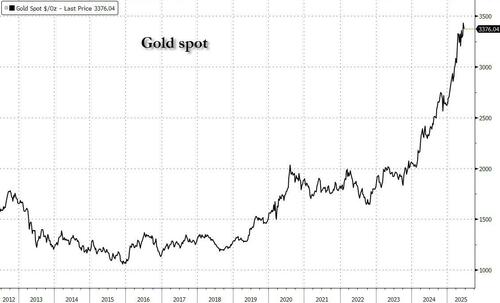

As the French bank goes on to note, the erosion of the dollar's share in global FX reserves, or de-dollarization, paused during the COVID crisis in 2020 but resumed in the second half of 2023. Since 3Q23, the share of USD FX reserves has fallen below 50%, representing a decline of -5.8%. The main beneficiary has been gold, which increased by +7.9% to 23.3%, reflecting how central banks are diversifying their dollar holdings...

... although one look at the price of gold would have been sufficient.

Perhaps the most surprising outcome of the dedollarization process is that process it has not benefited any of the major reserve currencies; indeed, the share of EUR, GBP, CNY and JPY has been declining too.

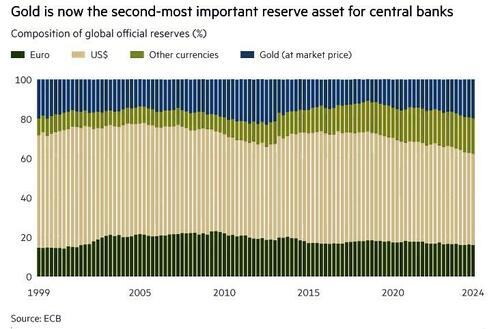

Meanwhile, despite the laughable attempts of ECB head Christine Lagarde to paint the Eurozone and the euro as somehow more stable than the world's reserve currency - when just over a decade ago the euro was hours away from disintegration and only Mario Draghi's a last ditch gambit to do "whatever it takes" prevented the complete disintegration of the Eurozone - Gold has now overtaken the euro as the world’s second-most important reserve asset for central banks, driven by record purchases and soaring prices, according to the European Central Bank.

As shown in the chart below, gold accounted for 20% of global official reserves last year, surpassing for the first time the euro’s 16%, and second only to the US dollar at 46%, data from an ECB report published on Wednesday showed.

“Central banks continued to accumulate gold at a record pace,” the ECB wrote, adding that central banks for the third year in a row acquired more than 1,000 tonnes of gold in 2024, a fifth of the total global annual production and twice the annual amount in the decade of the 2010s.

As the FT notes, the stock of gold held by central banks worldwide is approaching the historic highs of the postwar Bretton Woods era. Until 1971, global exchange rates were fixed to the dollar, which in turn could be converted into gold at a fixed exchange rate. That all ended with the Nixon gold shock in 1971.

Central bank gold reserves, which peaked at 38,000 tonnes in the mid-1960s, rose again to reach 36,000 tonnes in 2024, according to the latest ECB numbers. “Central banks worldwide now hold almost as much gold as they did in 1965,” the ECB report said.

Large buyers last year included India, China, Turkey and Poland, according to the World Gold Council.

While there are no indications that the relentless demand for gold among official buyers is slowing, the ECB noted that the supply of gold in recent decades increased during times of high prices: “If history is any guide, further increases in the official demand for gold reserves may also support further growth in global gold supply.”

Which is a wonderful theoretical thought experiment, the only problem is that now that gold has become a Giffen good (where demand only goes up with price), any incremental supply will be quickly absorbed by even more demand.

And if that is indeed the case, and the current trajectory of gold accumulation and dedollarization persist, expect gold to surpass the dollar as the world's preferred reserve currency sometime in 2030... right around the time US debt will be $50 trillion and bitcoin will be well over $1 million.

Which is ironic: a handful of powerful brought the end of the Bretton Woods world in the early 1970s, sparking an anti-gold regime which was adopted by a world kicking and screaming in disgust. 50 years later, without any outside influence, the world in which gold is once again the reserve "currency" has effectively returned.

Nature is healing.

More in the full Socgen note available to pro subs.

Tyler Durden

Tue, 06/17/2025 - 22:35

The post <a href=https://www.zerohedge.com/markets/gold-vs-dollar-death-fiat-one-chart target=_blank >Gold vs The Dollar: The Death Of Fiat In One Chart</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...