Chinese Firm Bought Insurer For CIA Agents As Part Of Trillion Dollar Spending Spree

For years, Washington assumed that China’s outbound investment flowed mainly into developing economies hungry for infrastructure money. But as scrutiny tightens across the West, it’s becoming clear that Beijing’s financial reach extended far deeper into wealthy nations - and far earlier - than most policymakers realized.

One early warning came in 2016, when Jeff Stein, a veteran journalist covering U.S. intelligence agencies, received an unusual tip: Wright USA, a small insurer that specialized in providing liability coverage for FBI and CIA personnel, had quietly been acquired the year before by Fosun Group, a Chinese conglomerate with reported ties to Beijing’s leadership. “Someone with direct knowledge called me up and said, ‘Do you know that the insurance company that insures intelligence personnel is owned by the Chinese?’” Stein recalls. “I was astonished.”

The concern was immediate and obvious. Wright USA held personal information on some of the most sensitive employees in the federal government. The question in Washington became not what the Chinese buyer intended, but who might ultimately gain access to the data. Newly released records reviewed by the BBC indicate that Chinese state banks helped finance the acquisition, routing a $1.2 billion loan through the Cayman Islands to enable Fosun’s purchase.

Though the deal violated no U.S. laws, it triggered alarm. Stein’s story in Newsweek soon prompted a rare inquiry by the Committee on Foreign Investment in the United States (CFIUS), the Treasury-led interagency panel responsible for policing foreign ownership risks. Within months, Wright USA was sold back to American owners. Neither Fosun nor Starr Wright USA, its new parent, responded to requests for comment.

High-level intelligence officials say the episode was among the cases that pushed the first Trump administration in 2018 to significantly tighten U.S. investment screening - part of a broader shift as the U.S. began rethinking a two-decade-old presumption that Chinese capital posed few national-security risks.

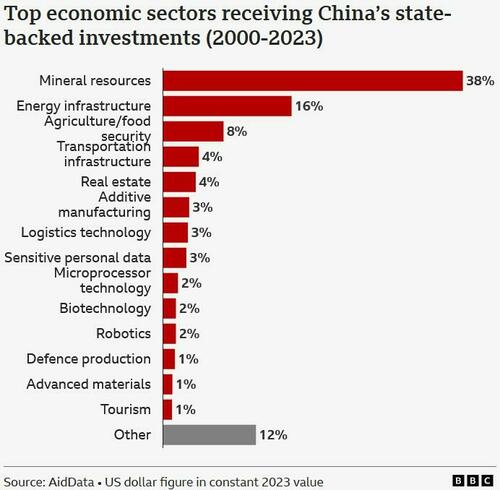

New research now suggests the Wright USA case was not an anomaly, but one instance in a vast global pattern. AidData, a research lab at William & Mary, has completed what it calls the first comprehensive tally of China’s state-backed investments abroad. Its findings, shared in advance with the BBC, show that Beijing has spent $2.1 trillion overseas since 2000 - roughly half in developing countries and half in advanced economies such as the United States, the United Kingdom, Germany, and Australia.

“For many years, we assumed China’s money flows were going to developing countries,” said Brad Parks, AidData’s executive director. “It came as a great surprise when we realized hundreds of billions were flowing into wealthy markets, happening right underneath our noses.”

China’s ability to project financial power abroad is tied to the enormous scale of its domestic banking system - now larger than those of the U.S., Europe, and Japan combined. Beijing exercises direct control over interest rates and credit allocation, giving it tools few governments possess. “This is only possible with very strict capital controls, which no other country could sustain,” said Victor Shih, director of the 21st Century China Center at the University of California, San Diego.

Many of the investments mapped by AidData appear commercial in nature. But others align with China’s long-running industrial strategy, including the now-muted - but still operative - “Made in China 2025” program, which aims to dominate sectors such as robotics, electric vehicles, and semiconductors.

Western governments have since moved aggressively to strengthen screening mechanisms over inbound capital. In the U.K., the U.S., and the Netherlands, regulators have derailed or unwound deals over fears that Chinese buyers could access strategically sensitive technologies. The Dutch government recently intervened in the operations of Nexperia, a Chinese-owned semiconductor firm, citing concerns that chip technologies could be transferred to its parent company. The move effectively split Nexperia’s Dutch operations from its China-based manufacturing arm - an extraordinary step in a country long known for economic openness.

But policymakers also warn against overcorrection. “There’s a danger of making it seem as if China is this monolith,” said Xiaoxue Martin, a research fellow at the Clingendael Institute in The Hague. “Most companies, especially private ones, just want to make money. They don’t want the negative reception they’re getting in Europe.”

Beijing rejects claims that its overseas investments are tools of statecraft. “Chinese companies… contribute actively to local economic growth, social development and job creation,” the Chinese embassy in London told the BBC, adding that they strictly follow local laws.

Still, the scale of the financing behind many transactions raises questions about where commercial intent ends and strategic interest begins. What Western officials now see, Parks argues, is a coordinated push. “At first, they thought these were individual initiatives from Chinese companies,” he said. “What they’ve learned is that Beijing’s party-state is behind the scenes writing the checks.”

(h/t Capital.news)

Tyler Durden

Tue, 11/18/2025 - 23:00

The post <a href=https://www.zerohedge.com/geopolitical/beijing-snapped-insurer-cia-agents-part-trillion-dollar-spending-spree target=_blank >Chinese Firm Bought Insurer For CIA Agents As Part Of Trillion Dollar Spending Spree</a> appeared first on Conservative Angle | Conservative Angle - Conservative News Clearing House

Continue reading...